Delving into Why invest in blue-chip stocks?, this introduction immerses readers in a unique and compelling narrative, with a focus on the stability, dividends, and historical performance of blue-chip stocks.

As we navigate through the characteristics, risks, and strategies associated with blue-chip stocks, a deeper understanding of their market value and potential returns will emerge.

Why Invest in Blue-Chip Stocks?

Blue-chip stocks are shares of large, well-established companies with a history of stable earnings and a solid reputation. These companies are known for their reliability and are considered to be leaders in their respective industries.

Concept of Blue-Chip Stocks

Blue-chip stocks are like the cornerstones of the stock market, representing companies with a strong track record of performance and stability. Investors often turn to blue-chip stocks for their consistent returns and lower risk compared to smaller or riskier investments.

Examples of Well-Known Blue-Chip Companies

- Apple Inc.

- Microsoft Corporation

- The Coca-Cola Company

- Johnson & Johnson

Historical Performance of Blue-Chip Stocks

Blue-chip stocks have historically outperformed other types of investments over the long term. These stocks tend to weather market downturns better and provide investors with a sense of security during turbulent times.

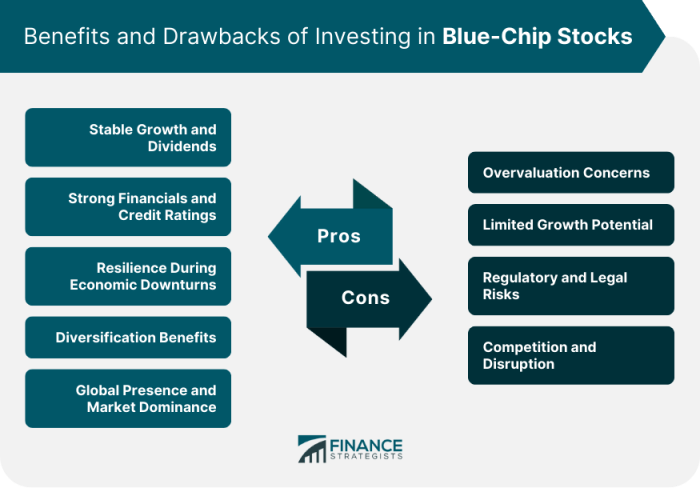

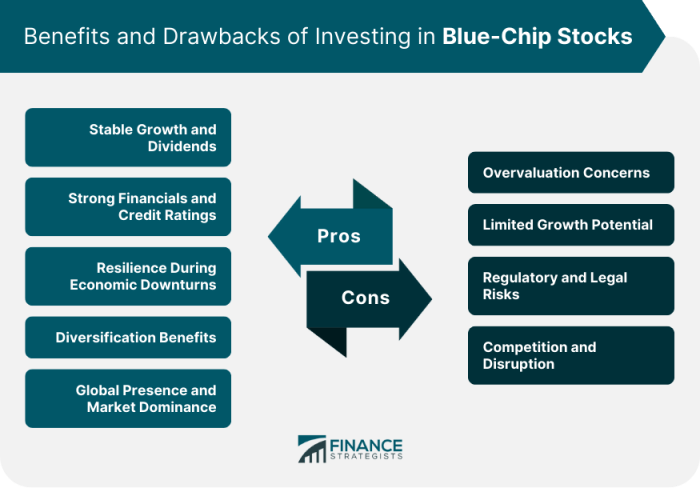

Key Benefits of Investing in Blue-Chip Stocks

- Stability: Blue-chip stocks are known for their stability and consistent performance, making them a reliable choice for long-term investors.

- Dividends: Many blue-chip companies pay dividends to their shareholders, providing an additional source of income on top of potential stock price appreciation.

- Reputation: Investing in blue-chip stocks allows investors to align themselves with well-established, reputable companies that have a proven track record of success.

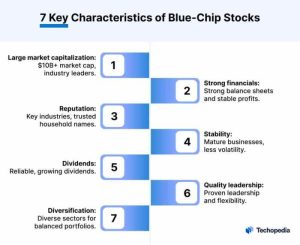

Characteristics of Blue-Chip Stocks

When it comes to investing, blue-chip stocks are often seen as reliable and stable investments. These stocks belong to well-established companies with a history of strong performance and stability. Let’s delve into the key characteristics that define blue-chip stocks.

Typical Characteristics

- Large Market Capitalization: Blue-chip stocks are typically issued by companies with a large market capitalization, indicating their size and stability in the market.

- Strong Financials: These companies have a history of consistent revenue and earnings growth, solid balance sheets, and a track record of paying dividends.

- Market Leaders: Blue-chip stocks are often industry leaders with a dominant market position and a recognizable brand name.

Comparison to Growth and Value Stocks

- Growth Stocks: Blue-chip stocks are known for their stability and lower volatility compared to growth stocks, which tend to focus on high growth potential but come with higher risk.

- Value Stocks: While value stocks are typically undervalued and have the potential for high returns, blue-chip stocks are considered safer investments with a focus on long-term stability.

Investor Perception of Risk and Return

- Risk: Blue-chip stocks are generally perceived as lower-risk investments due to the stability of the companies they represent. However, they are not immune to market fluctuations.

- Return: Investors often view blue-chip stocks as providing steady returns through dividends and potential capital appreciation over the long term.

Market Capitalization of Blue-Chip Companies

- Blue-chip companies typically have a market capitalization in the billions, reflecting their size, stability, and strong market presence.

- These companies are often part of major stock market indices, such as the S&P 500, further solidifying their status as blue-chip stocks.

Risks Associated with Blue-Chip Stocks

Investing in blue-chip stocks, while considered relatively safe compared to other types of investments, still carries certain risks that investors should be aware of. These risks can impact the performance and value of blue-chip stocks, and understanding them is crucial for making informed investment decisions.

Market Volatility

Market volatility can have a significant impact on the value of blue-chip stocks. Fluctuations in the stock market can result in sudden and unexpected price changes, leading to potential losses for investors holding blue-chip stocks.

Company-Specific Risks

Even though blue-chip companies are well-established and have a strong track record, they are not immune to company-specific risks. Factors such as management changes, regulatory issues, or competitive pressures can affect the performance of blue-chip stocks.

Interest Rate Changes

Changes in interest rates can also influence the value of blue-chip stocks. Rising interest rates can lead to higher borrowing costs for companies, impacting their profitability and stock prices. Investors need to consider the potential impact of interest rate changes on their blue-chip investments.

Global Economic Conditions

Blue-chip stocks are often multinational companies, which means they can be affected by global economic conditions. Factors such as geopolitical tensions, trade policies, or economic downturns in key markets can impact the performance of blue-chip stocks.

Strategies to Mitigate Risks

To mitigate risks when investing in blue-chip stocks, investors can diversify their portfolios across different sectors and asset classes. Additionally, conducting thorough research on companies and staying informed about market trends can help investors make informed decisions and reduce exposure to potential risks.

Strategies for Investing in Blue-Chip Stocks

When it comes to investing in blue-chip stocks, having a well-thought-out strategy is key to achieving your financial goals. Here, we will explore different approaches to building a portfolio with blue-chip stocks, the importance of diversification, tips for selecting the right stocks, and insights on timing your buys and sells for optimal returns.

Diversification in Blue-Chip Stock Portfolio

Diversification is crucial when investing in blue-chip stocks to reduce risk and maximize returns. By spreading your investments across different sectors and industries, you can protect your portfolio from the volatility of any single stock or sector.

Choosing the Right Blue-Chip Stocks

When selecting blue-chip stocks, consider your investment goals, risk tolerance, and time horizon. Look for companies with a strong track record of performance, stability, and consistent dividends. Conduct thorough research on the company’s financial health, competitive position, and growth prospects.

Timing Your Buys and Sells

Timing is crucial when it comes to buying and selling blue-chip stocks. Consider buying when the stock is undervalued relative to its intrinsic value and selling when it is overvalued. Keep an eye on market trends, economic indicators, and company-specific news to make informed decisions.

In conclusion, investing in blue-chip stocks offers a blend of security and growth potential, making them a favorable choice for many investors seeking long-term profitability.

FAQ

What are blue-chip stocks?

Blue-chip stocks are shares of large, well-established companies with a history of stable performance and reliable dividends.

How do blue-chip stocks compare to growth stocks and value stocks?

Blue-chip stocks are known for stability and dividends, unlike growth stocks that offer higher potential returns but with more risk, and value stocks that are undervalued by the market.

What risks are associated with investing in blue-chip stocks?

While generally stable, blue-chip stocks can still be affected by market fluctuations, economic conditions, and company-specific challenges.

How can one mitigate risks when investing in blue-chip stocks?

Diversification, thorough research, and staying informed about market trends can help reduce risks associated with investing in blue-chip stocks.