What are blue-chip stocks? An Overview sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset.

Blue-chip stocks are a staple in the financial market, known for their stability and performance. This guide will delve into what makes them stand out and why they are a popular investment choice.

BLUE-CHIP STOCKS

Blue-chip stocks are shares of large, well-established companies with a history of stable earnings and reliable performance in the market. These stocks are considered to be some of the most financially sound investments available.

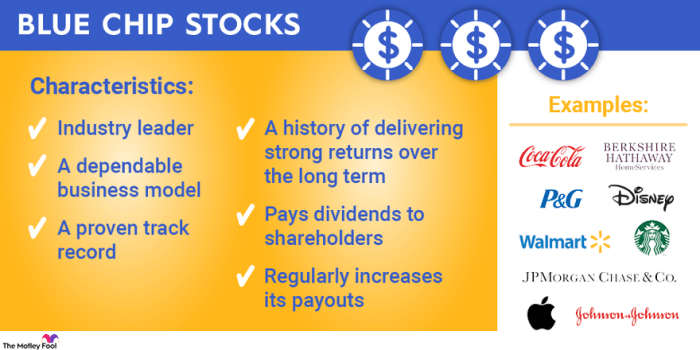

Examples of Blue-Chip Stocks

- Apple Inc. (AAPL)

- The Coca-Cola Company (KO)

- Johnson & Johnson (JNJ)

- Microsoft Corporation (MSFT)

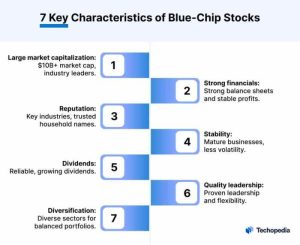

Characteristics of Blue-Chip Stocks

- Market Leadership: Blue-chip companies are typically leaders in their industry.

- Stable Dividend Payments: These stocks often pay regular dividends to shareholders.

- Strong Financials: Blue-chip companies have solid balance sheets and consistent earnings.

- Long Track Record: These stocks have a history of sustained growth and success.

Why Blue-Chip Stocks are Considered Stable Investments

Blue-chip stocks are considered stable investments due to their resilience during market downturns and economic uncertainties. Investors often turn to blue-chip stocks for their reliability, long-term growth potential, and ability to weather market volatility. These companies are seen as less risky compared to smaller or newer companies, making them a popular choice for investors looking for a secure investment option.

INVESTING IN BLUE-CHIP STOCKS

Investing in blue-chip stocks can be a solid strategy for long-term growth and stability in your investment portfolio. These well-established companies with a history of reliable performance are considered less risky compared to other types of stocks.Blue-chip stocks are known for their stability, consistent dividends, and strong performance even during economic downturns. Here are some strategies for investing in blue-chip stocks:

Strategies for Investing in Blue-Chip Stocks

- Research and select companies with a solid track record of growth and stability.

- Look for companies with a competitive advantage in their industry.

- Consider diversifying your investments by choosing blue-chip stocks from different sectors.

- Monitor market trends and company performance regularly to make informed decisions.

Risks and Benefits of Investing in Blue-Chip Stocks

- Benefits:

- Stability and consistent returns over time.

- Lower risk compared to other types of stocks.

- Ability to weather economic downturns better than smaller companies.

- Risks:

- Potential for slower growth compared to high-risk stocks.

- Market volatility can still impact blue-chip stocks.

Blue-Chip Stocks in a Diversified Portfolio

- Blue-chip stocks can serve as a stable foundation in a diversified investment portfolio.

- By combining blue-chip stocks with other types of investments, you can reduce overall risk and increase potential returns.

Historical Performance of Blue-Chip Stocks

- Blue-chip stocks have historically shown resilience during economic downturns.

- Many blue-chip companies have continued to pay dividends even when facing challenging economic conditions.

IDENTIFYING BLUE-CHIP STOCKS

When it comes to identifying blue-chip stocks, there are specific criteria and factors that investors look for to determine the stability and reliability of these companies.

Criteria for Identifying Blue-Chip Stocks

Blue-chip stocks are typically well-established companies with a history of strong performance and stability. Some key criteria used to identify blue-chip stocks include:

- Market Capitalization: Blue-chip stocks are usually large-cap companies with a market capitalization in the billions.

- Company Reputation: These companies have a solid reputation in their respective industries and are often leaders in their sector.

- Stable Dividend Payments: Blue-chip stocks often have a history of paying consistent dividends to their shareholders.

- Strong Financials: These companies have solid financial statements, including healthy balance sheets, consistent earnings growth, and low debt levels.

Tips for Beginners on Researching Blue-Chip Stocks

For beginners looking to invest in blue-chip stocks, it is essential to conduct thorough research to identify the right opportunities. Some tips for researching and identifying blue-chip stocks include:

- Utilize Financial Websites: Use financial websites and tools to research company financials, stock performance, and analyst ratings.

- Follow Market News: Stay updated on market trends and news related to potential blue-chip stock investments.

- Consult with Financial Advisors: Seek advice from financial advisors or experts to guide your investment decisions.

Role of Market Capitalization and Company Reputation

Market capitalization plays a significant role in identifying blue-chip stocks, as these companies are typically large-cap stocks with a market value in the billions. Additionally, company reputation is crucial, as blue-chip stocks are known for their strong brand presence and leadership in their industries.

Importance of Analyzing Financial Statements

Analyzing financial statements is crucial when evaluating blue-chip stocks. Investors should look at key financial metrics such as revenue growth, earnings per share, and return on equity to assess the financial health and performance of these companies.

BLUE-CHIP STOCKS VS. OTHER STOCKS

When comparing blue-chip stocks to growth stocks and value stocks, it’s essential to understand the key differences in terms of performance, risk, and dividend payouts.

Differences Between Blue-Chip, Growth, and Value Stocks

- Blue-chip stocks are established, stable companies with a long history of reliable performance and typically pay dividends to shareholders. They are considered safer investments compared to growth and value stocks.

- Growth stocks are companies expected to have above-average growth in revenue and earnings. They often reinvest their earnings back into the business rather than paying dividends, making them riskier but potentially offering higher returns.

- Value stocks are considered undervalued based on metrics like price-to-earnings ratio or book value. Investors buy these stocks hoping they will eventually rise in value, offering potential returns once the market corrects their undervaluation.

Performance Comparison

Blue-chip stocks tend to perform well during market downturns due to their stability, while growth stocks may suffer more significant losses. Value stocks may also struggle during economic downturns but can present opportunities for long-term gains once the market recovers.

Risk Associated with Blue-Chip Stocks

Blue-chip stocks are generally considered less risky than growth or value stocks due to their stable performance and history of consistent dividend payments. However, they are not immune to market fluctuations and can still experience losses during economic downturns.

Role of Dividends

Dividends are a key factor that distinguishes blue-chip stocks from growth and value stocks.

Blue-chip companies typically pay dividends to their shareholders, providing a steady income stream. In contrast, growth stocks reinvest their earnings into the company for expansion, while value stocks may not offer consistent dividend payouts.

In conclusion, blue-chip stocks continue to be a reliable option for investors seeking stability and long-term growth in their portfolios. Understanding the nuances of these stocks can lead to informed investment decisions and potential financial success.

Questions and Answers

What are blue-chip stocks?

Blue-chip stocks are shares of large, well-established companies with a history of stable earnings and strong financials.

How do blue-chip stocks differ from other types of stocks?

Blue-chip stocks are known for their stability and lower risk compared to growth or value stocks. They often pay dividends and have a solid reputation in the market.

Why are blue-chip stocks considered stable investments?

Blue-chip stocks are considered stable due to the financial strength of the companies behind them, which have a track record of weathering economic downturns.