Exploring the top-performing blue-chip stocks over the last 10 years, this introduction delves into the remarkable success stories of these investments, providing insights into their performance and impact.

It highlights the key factors that have led to their outstanding performance and why they are favored by investors seeking stability and growth in their portfolios.

Introduction to Blue-Chip Stocks

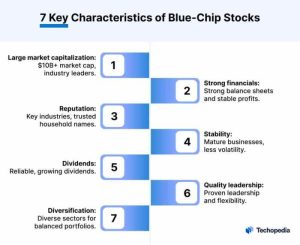

Blue-chip stocks are shares of large, well-established companies with a history of stable earnings and a strong financial position. These companies are typically industry leaders, have a proven track record of success, and are known for their resilience even during economic downturns.Blue-chip stocks are considered safe and reliable investments for several reasons. Firstly, these companies have a long history of paying dividends, providing investors with a steady income stream.

Secondly, blue-chip stocks are less volatile compared to other types of stocks, making them a more stable investment option. Additionally, these companies have a wide economic moat, meaning they have a competitive advantage that helps them maintain their market dominance.Historically, blue-chip stocks have outperformed the market over the long term. Due to their strong financial position and market leadership, these stocks have shown consistent growth and have provided investors with attractive returns.

Investors often turn to blue-chip stocks as a core component of their investment portfolios due to their stability and potential for long-term growth.

Historical Performance of Blue-Chip Stocks

Blue-chip stocks have demonstrated impressive performance over the years, consistently delivering solid returns to investors. Some of the top blue-chip stocks have shown remarkable resilience during market downturns, making them a popular choice for investors seeking stability and growth in their portfolios.

- Companies like Apple, Microsoft, and Johnson & Johnson have been considered top-performing blue-chip stocks, consistently delivering strong financial results and shareholder value.

- Blue-chip stocks have a proven track record of weathering market volatility and economic uncertainties, making them attractive investment options for risk-averse investors.

- These stocks have historically provided investors with a reliable source of income through dividends, contributing to their appeal as long-term investment opportunities.

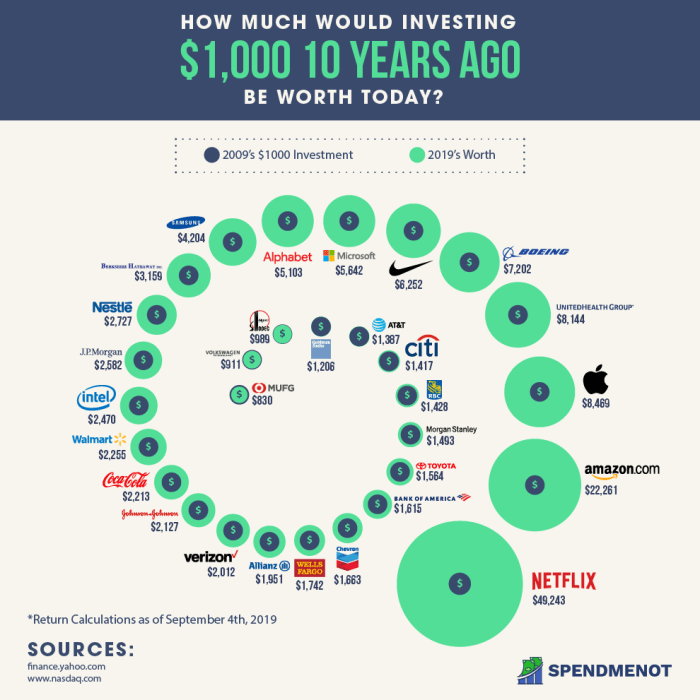

Top-performing Blue-Chip Stocks Over the Last 10 Years

Blue-chip stocks are known for their stability and strong performance over time. In the past decade, several blue-chip stocks have stood out for their exceptional growth and returns.

Examples of Top-performing Blue-Chip Stocks

- Apple Inc. (AAPL)

- Microsoft Corporation (MSFT)

- Amazon.com Inc. (AMZN)

- Alphabet Inc. (GOOGL)

- Visa Inc. (V)

These companies have consistently shown impressive growth and stock price appreciation over the last 10 years.

Factors Contributing to Success

- Strong Leadership: These companies have visionary leaders who have steered them towards success through innovation and strategic decision-making.

- Market Dominance: Many of these top-performing blue-chip stocks operate in sectors where they have established themselves as market leaders, giving them a competitive edge.

- Financial Health: Sound financial management and healthy balance sheets have contributed to their long-term success and resilience.

Sectors or Industries Impacting Performance

- Tech Sector: Companies like Apple, Microsoft, and Alphabet belong to the technology sector, which has been a major driver of stock market growth in the past decade.

- Retail and E-commerce: Amazon’s success is a testament to the booming e-commerce industry and the shift towards online shopping.

- Financial Services: Visa’s dominance in the payment processing industry has been a key factor in its strong performance.

These sectors have played a significant role in the success of these top-performing blue-chip stocks over the last 10 years.

Criteria for Identifying Top-performing Blue-Chip Stocks

When it comes to identifying top-performing blue-chip stocks, investors often rely on key metrics to make informed decisions. These metrics help assess the financial health, stability, and growth potential of these established companies.

Performance Metrics for Blue-Chip Stocks

- Market Capitalization: Large market capitalization indicates a stable and well-established company.

- Dividend Yield: Dividend-paying blue-chip stocks provide regular income to investors, making them attractive for income-seeking investors.

- Price-to-Earnings (P/E) Ratio: A low P/E ratio suggests that a stock may be undervalued, presenting a buying opportunity.

- Revenue Growth: Consistent revenue growth over time indicates a strong business model and potential for future returns.

- Profit Margin: A high profit margin signifies efficient operations and profitability.

Dividend-paying vs. Growth-oriented Blue-Chip Stocks

- Dividend-paying blue-chip stocks: These stocks offer regular dividend payments, providing income to investors, especially during market downturns.

- Growth-oriented blue-chip stocks: These stocks reinvest profits for future growth, potentially leading to capital appreciation over time.

- Investors may choose dividend-paying stocks for income stability and growth-oriented stocks for long-term capital appreciation.

Influence of Economic Conditions on Blue-Chip Stocks

- Interest Rates: Lower interest rates may make blue-chip stocks more attractive compared to fixed-income investments.

- Economic Growth: Strong economic growth can positively impact blue-chip stocks by increasing consumer spending and corporate profits.

- Inflation: Moderate inflation may benefit blue-chip stocks by allowing companies to increase prices and maintain profit margins.

- Global Events: Geopolitical tensions or global events can impact blue-chip stocks by affecting consumer confidence and market volatility.

In conclusion, the journey through the top-performing blue-chip stocks over the last decade reveals the resilience and profitability of these renowned investments, showcasing their enduring value in the ever-changing market landscape.

Popular Questions

What are some examples of top-performing blue-chip stocks over the last 10 years?

Some examples include Apple, Microsoft, Amazon, and Visa.

How do economic conditions impact the performance of blue-chip stocks?

Economic conditions such as interest rates, inflation, and GDP growth can influence the stock market and consequently impact blue-chip stocks.

What key metrics do investors use to identify high-performing blue-chip stocks?

Investors often look at metrics like earnings per share, price-to-earnings ratio, and dividend yield to evaluate blue-chip stocks.