Embark on a journey exploring the allure of top blue-chip stocks for long-term investment, uncovering the secrets behind their enduring appeal and solid performance in the market.

Delve into the world of renowned companies that offer stability and growth potential, making them ideal picks for savvy investors seeking lasting financial success.

Understanding Blue-Chip Stocks

Blue-chip stocks are shares of large, well-established companies with a history of stable earnings and a solid reputation in the market. These companies are household names that are leaders in their respective industries.

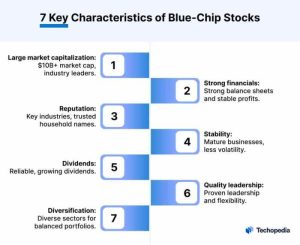

Characteristics of Blue-Chip Stocks

- Blue-chip stocks typically have a long track record of paying dividends to their shareholders, showcasing financial stability.

- They often have a market capitalization in the billions, indicating their size and presence in the market.

- These stocks are known for their resilience during economic downturns, making them a safe haven for investors.

Examples of Blue-Chip Companies

Some well-known blue-chip companies include:

- Apple Inc.

- Microsoft Corporation

- The Coca-Cola Company

- Johnson & Johnson

Why Blue-Chip Stocks are Considered Safe Long-Term Investments

- Investors often view blue-chip stocks as safe long-term investments due to their stable performance over time.

- These companies have a proven track record of weathering market fluctuations and delivering consistent returns to shareholders.

- Blue-chip stocks are seen as less volatile compared to smaller, riskier investments, providing a sense of security for long-term investors.

Criteria for Selecting Top Blue-Chip Stocks

When choosing blue-chip stocks for long-term investment, it is crucial to consider several key criteria that can impact the success of your investment. Factors such as financial stability, market dominance, consistent dividend payouts, track record, and industry sector play a significant role in determining which blue-chip stocks are the best fit for your investment portfolio.

Financial Stability and Market Dominance

Financial stability is a crucial factor to consider when selecting blue-chip stocks. Companies with strong balance sheets, low debt levels, and stable cash flows are more likely to weather economic downturns and continue to perform well over the long term. Market dominance is another important aspect to look at. Blue-chip stocks that hold a significant market share in their respective industries are often more resilient to competition and market fluctuations.

- Companies with consistent revenue growth and profitability are generally considered more financially stable.

- Market dominance can be indicated by a company’s brand recognition, customer loyalty, and competitive advantages within the industry.

Consistent Dividend Payouts and Track Record

Consistent dividend payouts are a key feature of many blue-chip stocks. Companies that have a history of paying dividends regularly, and increasing them over time, are often seen as reliable investments for income-seeking investors. Additionally, analyzing a company’s track record and performance history can provide valuable insights into its management team, strategic decisions, and ability to adapt to changing market conditions.

- Dividend yield and payout ratio are important metrics to consider when evaluating a company’s dividend policy.

- Looking at a company’s historical stock performance, earnings growth, and dividend history can help assess its long-term potential.

Industry Sector and Growth Potential

The industry sector in which a blue-chip stock operates can also influence its long-term performance. Some sectors may be more stable and defensive, while others offer higher growth potential but come with increased risk. Understanding the industry dynamics, market trends, and growth prospects can help investors make informed decisions when selecting blue-chip stocks for their portfolio.

- Comparing and contrasting blue-chip stocks within the same industry sector can provide insights into their competitive positioning and growth opportunities.

- Considering the future growth potential of a company based on industry trends, technological advancements, and market demand can help identify top-performing blue-chip stocks.

Top Blue-Chip Stocks for Long-Term Investment

Blue-chip stocks are known for their stability, strong financials, and long-standing reputation in the market. Here are some of the top blue-chip stocks that are popular choices for long-term investment:

1. Apple Inc. (AAPL)

Apple has consistently been one of the most sought-after blue-chip stocks for long-term investment. The company’s innovation, brand loyalty, and diversified product portfolio have contributed to its success. Over the past few years, Apple’s stock price has shown steady growth, making it a reliable choice for investors.

2. Microsoft Corporation (MSFT)

Microsoft is another top blue-chip stock that has shown impressive performance over the years. The company’s dominance in the software industry, strong financials, and focus on cloud computing have driven its growth. Microsoft’s stock has weathered economic downturns and market volatility, making it a stable investment option.

3. Johnson & Johnson (JNJ)

Johnson & Johnson is a leading healthcare company and a popular blue-chip stock for long-term investment. The company’s diversified product line, global presence, and commitment to research and development have contributed to its success. Despite challenges in the healthcare industry, Johnson & Johnson has maintained stability and growth, making it an attractive choice for investors.

4. The Coca-Cola Company (KO)

Coca-Cola is a well-known beverage company with a strong global presence. The company’s iconic brand, extensive distribution network, and focus on innovation have helped it maintain its position as a top blue-chip stock. Despite changes in consumer preferences and market dynamics, Coca-Cola has demonstrated resilience and continues to offer long-term growth potential.

Strategies for Investing in Blue-Chip Stocks

When it comes to investing in blue-chip stocks for the long term, there are several strategies that investors can consider to maximize their returns and minimize risks. One of the key strategies is to focus on companies with a proven track record of stability, strong financials, and a history of paying dividends consistently over time. These companies are often considered safe havens for investors looking for steady growth and income.

Benefits of Dollar-Cost Averaging

Dollar-cost averaging is a strategy where investors regularly invest a fixed amount of money in a particular stock or portfolio over time, regardless of the share price. This strategy helps to reduce the impact of market volatility on your investment and can potentially lower the average cost per share over the long term. By consistently buying shares at different prices, investors can benefit from market fluctuations and potentially increase their overall returns.

Diversification to Reduce Risk

Diversification is another important strategy when building a portfolio of blue-chip stocks. By investing in a variety of blue-chip companies across different sectors and industries, investors can spread out their risk and reduce the impact of any single stock underperforming. This helps to protect the overall portfolio from significant losses and provides a more stable investment approach over time.

Monitoring and Adjusting Investments

It is crucial for investors to regularly monitor their blue-chip stock investments and make adjustments as needed. This includes staying informed about the latest news and developments surrounding the companies in which you have invested, as well as evaluating the overall performance of your portfolio. By staying proactive and making informed decisions based on market conditions and company performance, investors can optimize their blue-chip stock investments for long-term growth and profitability.

In conclusion, top blue-chip stocks stand as pillars of reliability and resilience in the ever-changing landscape of the stock market, providing a secure foundation for long-term investment strategies.

Detailed FAQs

What sets blue-chip stocks apart from other investments?

Blue-chip stocks are shares of large, well-established companies with a history of stable earnings and reliable dividends, making them attractive for long-term investors.

How can investors identify top blue-chip stocks for long-term investment?

Investors should look for companies with strong financials, market leadership, consistent dividend payouts, and a solid track record of performance and growth.

Are blue-chip stocks immune to market volatility?

While blue-chip stocks are generally more stable than other investments, they are not entirely immune to market fluctuations. However, their strong fundamentals often help them weather economic downturns better.