Dive into the world of low-risk blue-chip stocks with this comprehensive guide, exploring key strategies and insights for savvy investors.

Unveil the secrets behind identifying these stable investments and maximizing returns with expert tips and criteria.

Understanding Blue-Chip Stocks

Blue-chip stocks are shares of large, well-established companies with a history of stable earnings and reliable performance. These companies are typically industry leaders and are considered to be financially stable, making them attractive investments for many investors.

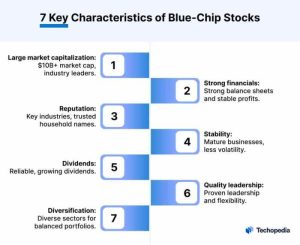

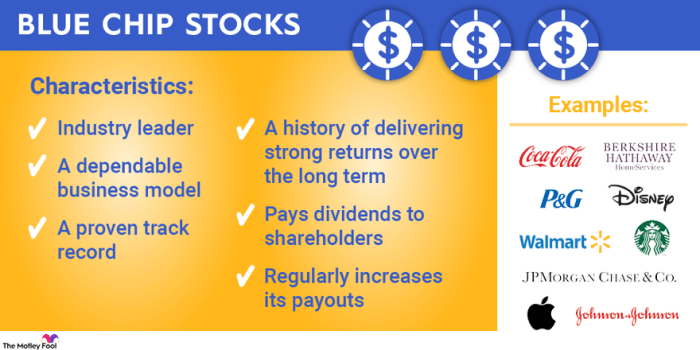

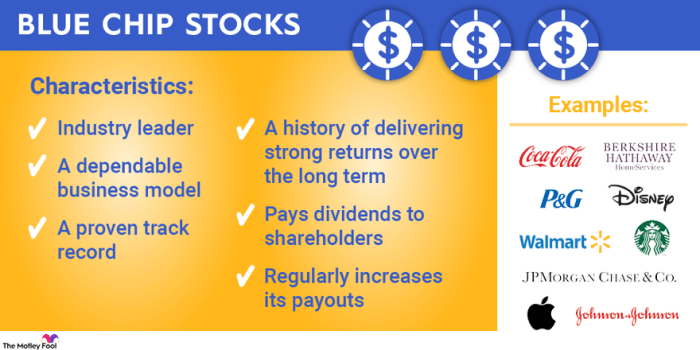

Characteristics of Blue-Chip Stocks

- Stable and reliable performance over time

- Strong market presence and brand recognition

- Consistent dividend payments

- Low volatility compared to other stocks

Examples of Blue-Chip Companies

- Apple Inc. (AAPL)

- Microsoft Corporation (MSFT)

- The Coca-Cola Company (KO)

- Johnson & Johnson (JNJ)

Historical Performance of Blue-Chip Stocks

Blue-chip stocks have historically outperformed other types of stocks during economic downturns and periods of market volatility. Investors often turn to blue-chip stocks as a safe haven during uncertain times, as these companies tend to weather economic storms better than smaller or riskier investments.

Identifying Low-Risk Blue-Chip Stocks

When it comes to investing, the concept of low-risk is crucial for investors looking for stability and consistent returns. Low-risk blue-chip stocks are particularly attractive due to their reliable performance and reputation in the market. Let’s delve into how these stocks offer stability and how to identify them.

Low-Risk in Investing

Investing in low-risk assets involves putting your money into opportunities that have a lower probability of losing value. This typically means choosing investments with a history of stable performance and lower volatility. Low-risk investments are favored by conservative investors seeking to protect their capital while still earning returns.

Stability and Consistent Returns of Low-Risk Blue-Chip Stocks

Low-risk blue-chip stocks belong to well-established companies with a track record of stable earnings and dividend payments. These companies are leaders in their respective industries, with strong fundamentals and competitive advantages. Investing in low-risk blue-chip stocks provides investors with a sense of security, as these companies are less likely to face financial distress or significant stock price fluctuations.

Criteria for Identifying Low-Risk Blue-Chip Stocks

1. Longevity

Look for companies with a long history of operations and market presence.

2. Financial Health

Analyze the company’s balance sheet, cash flow, and debt levels to ensure stability.

3. Dividend History

Companies with a consistent track record of paying dividends are often more stable.

4. Market Position

Focus on industry leaders with a strong competitive advantage.

5. Economic Moat

Consider companies with a wide economic moat, meaning they have sustainable competitive advantages that protect their market share.

Risk Levels of Low-Risk Blue-Chip Stocks Compared to Other Investments

Compared to other investment options, low-risk blue-chip stocks generally offer a lower level of risk. While no investment is entirely risk-free, these stocks tend to be less volatile and more resilient during market downturns. In contrast, riskier investments such as growth stocks or speculative assets may experience higher levels of volatility and potential losses.

Factors Influencing Low-Risk Blue-Chip Stocks

When it comes to low-risk blue-chip stocks, several factors can influence their performance and risk profile. Understanding these factors is crucial for investors looking to make informed decisions in the stock market.

Economic Factors Impacting Low-Risk Blue-Chip Stocks

- Economic indicators: Changes in GDP, inflation rates, and interest rates can directly impact the performance of blue-chip stocks. A strong economy generally bodes well for these stocks, while economic downturns can lead to increased risk.

- Global market trends: International economic conditions, trade agreements, and geopolitical events can also affect the stability and risk associated with low-risk blue-chip stocks.

Market Conditions and Risk Profile of Blue-Chip Stocks

- Market volatility: Fluctuations in the stock market can influence the risk profile of blue-chip stocks. High volatility may increase risk, while stable market conditions can reduce it.

- Investor sentiment: Market sentiment and investor behavior can impact the demand for blue-chip stocks, affecting their risk levels. Positive sentiment can lower risk, while negative sentiment can increase it.

Role of Company Fundamentals in Risk Determination

- Financial health: The financial stability, profitability, and growth potential of a company play a significant role in determining the risk associated with its stock. Strong fundamentals can lower the risk of investing in blue-chip stocks.

- Dividend payments: Consistent dividend payments and a history of dividend growth can also signal a lower-risk investment in blue-chip stocks.

External Events and Risk Levels of Blue-Chip Stocks

- Regulatory changes: Changes in regulations and government policies can impact the risk levels of blue-chip stocks, especially in regulated industries such as healthcare or finance.

- Natural disasters or pandemics: External events like natural disasters or global health crises can disrupt markets and influence the risk associated with blue-chip stocks, leading to increased volatility.

Strategies for Investing in Low-Risk Blue-Chip Stocks

When it comes to investing in low-risk blue-chip stocks, there are several strategies that investors can consider to optimize their portfolio and maximize returns.

Diversification in Blue-Chip Stock Investments

Diversification is a key strategy when investing in blue-chip stocks. By spreading your investment across different sectors and industries, you can reduce the risk of significant losses if one sector underperforms. It is essential to have a well-diversified portfolio to protect your investments in the long run.

Tips for Long-Term Investors

For long-term investors interested in low-risk blue-chip stocks, it is crucial to focus on companies with a proven track record of stability and consistent growth. Look for companies that have a history of paying dividends and have strong fundamentals. Additionally, it is essential to stay updated on market trends and economic indicators to make informed investment decisions.

Potential Returns and Growth Prospects

Investing in low-risk blue-chip stocks can provide investors with steady returns and long-term growth prospects. While the returns may not be as high as riskier investments, blue-chip stocks offer stability and security, making them an attractive option for conservative investors. By carefully selecting blue-chip stocks with strong fundamentals and growth potential, investors can build a resilient portfolio that can weather market fluctuations.

In conclusion, low-risk blue-chip stocks offer a secure investment option with potential for long-term growth, making them a valuable addition to any portfolio.

Query Resolution

What are the key characteristics of low-risk blue-chip stocks?

Low-risk blue-chip stocks are known for their stability, strong track record, and consistent returns over time.

How can investors identify low-risk blue-chip stocks?

Investors can look for companies with solid financials, long-standing reputation, and a history of paying dividends.

Why are low-risk blue-chip stocks considered a safe investment?

These stocks are less volatile and offer a cushion against market fluctuations, making them a safer choice for risk-averse investors.