Embark on a journey to discover the world of blue-chip stocks and learn the ins and outs of smart investing with a focus on stability and long-term growth.

Explore the defining features, benefits, identification methods, and strategies that will empower you to make informed investment decisions in the stock market.

Blue-Chip Stocks Overview

Blue-chip stocks are shares of well-established, financially stable, and reputable companies that have a long history of reliable performance. These stocks are considered a stable investment due to their track record of consistent dividend payments, strong financials, and market leadership positions.

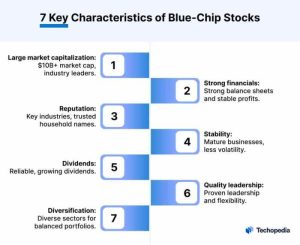

Characteristics of Blue-Chip Stocks

Blue-chip stocks typically exhibit the following characteristics:

- Large Market Capitalization: Blue-chip companies have a high market value, indicating their size and stability in the market.

- Strong Financial Performance: These companies often have a history of steady revenue growth, profitability, and cash flow.

- Longevity and Stability: Blue-chip stocks are usually industry leaders with a long history of success and resilience in various market conditions.

- Dividend Payments: Many blue-chip companies pay regular dividends to their shareholders, providing an additional income stream.

- Reputation and Brand Recognition: These companies are well-known, respected, and trusted by investors and consumers alike.

Historical Performance of Blue-Chip Stocks

Blue-chip stocks have historically outperformed other types of investments over the long term. Due to their stable nature and strong financial fundamentals, blue-chip stocks have provided investors with consistent returns and capital appreciation. Additionally, during times of market volatility or economic downturns, blue-chip stocks have shown resilience and tend to recover faster compared to smaller or riskier investments.

Benefits of Investing in Blue-Chip Stocks

Investing in blue-chip stocks offers several advantages for long-term growth and stability in an investment portfolio. These well-established companies are known for their strong financial performance and solid track record, making them a preferred choice for many investors.

Stability in Investment Portfolio

Blue-chip stocks provide stability to an investment portfolio due to their proven track record of consistent growth and profitability over the years. These companies are typically market leaders in their respective industries, with a history of weathering economic downturns and volatile market conditions. As a result, investing in blue-chip stocks can help balance out the overall risk in a portfolio and provide a reliable source of returns.

Dividend Payments

One of the key attractions of blue-chip stocks is their tendency to offer dividends to investors. These dividend payments are a share of the company’s profits distributed to shareholders on a regular basis. By investing in blue-chip stocks that pay dividends, investors can benefit from a steady income stream in addition to potential capital appreciation. This can be particularly appealing for income-oriented investors looking for a source of passive income.

How to Identify Blue-Chip Stocks

When it comes to identifying blue-chip stocks, investors typically look for companies that have a long history of stable earnings, a strong balance sheet, and a solid track record of paying dividends. These stocks are considered to be industry leaders and are usually well-established companies with a market capitalization in the billions.

Criteria for Identifying Blue-Chip Stocks

- Market Capitalization: Blue-chip stocks are generally large-cap companies with a market capitalization in the billions.

- Stable Earnings: These stocks have a history of stable and consistent earnings growth over the years.

- Dividend Payments: Blue-chip stocks often pay dividends regularly to their shareholders.

- Strong Balance Sheet: Companies with strong balance sheets, low debt levels, and healthy cash reserves are considered blue-chip stocks.

Comparison with Other Types of Stocks

- Blue-Chip vs. Growth Stocks: While blue-chip stocks are known for their stability and established track record, growth stocks are more focused on high growth potential and may not pay dividends.

- Blue-Chip vs. Value Stocks: Value stocks are typically undervalued by the market, while blue-chip stocks are recognized for their quality, stability, and reliability.

Examples of Blue-Chip Stocks

| Sector | Blue-Chip Stocks |

|---|---|

| Technology | Apple Inc. (AAPL) |

| Consumer Goods | The Coca-Cola Company (KO) |

| Finance | JPMorgan Chase & Co. (JPM) |

| Healthcare | Johnson & Johnson (JNJ) |

Strategies for Investing in Blue-Chip Stocks

Investing in blue-chip stocks requires careful consideration and strategic planning to maximize returns and minimize risks. Here are some key strategies to keep in mind:

1. Long-Term Investment Approach

- Blue-chip stocks are known for their stability and consistent growth over time. Adopting a long-term investment approach allows investors to benefit from the compounding effect and ride out short-term market fluctuations.

- By focusing on the fundamentals of the company and holding onto your investments for an extended period, you can capitalize on the growth potential of blue-chip stocks.

2. Dollar-Cost Averaging

- Instead of trying to time the market, consider implementing a dollar-cost averaging strategy when purchasing blue-chip stocks.

- By investing a fixed amount of money at regular intervals, regardless of market conditions, you can reduce the impact of market volatility and potentially lower your average cost per share over time.

3. Diversification

- Diversification is key to managing risk in any investment portfolio, including blue-chip stocks.

- Spread your investments across different sectors and industries to reduce exposure to any single stock or sector-specific risks.

- By diversifying your holdings, you can protect your portfolio from significant losses in case of a downturn in a particular industry.

4. Reinvesting Dividends

- Many blue-chip stocks pay regular dividends to their shareholders, providing a steady stream of income.

- Consider reinvesting these dividends back into the same company or other blue-chip stocks to take advantage of the power of compounding.

- Reinvesting dividends can help accelerate the growth of your investment portfolio over time.

In conclusion, mastering the art of investing in blue-chip stocks opens doors to financial success and security. Make strategic moves, stay diversified, and watch your investment portfolio thrive in the long run.

Query Resolution

How can I differentiate blue-chip stocks from other types of stocks?

Blue-chip stocks are typically large, well-established companies with a history of stable performance, strong financials, and a solid reputation in the market.

Are blue-chip stocks suitable for short-term gains?

Blue-chip stocks are more geared towards long-term growth and stability rather than short-term gains, as they are known for consistent dividends and reliability.

Is diversification important when investing in blue-chip stocks?

Yes, diversification is crucial to mitigate risks and ensure a well-balanced investment portfolio, even when focusing on blue-chip stocks.

Can market conditions affect the performance of blue-chip stocks?

Market conditions such as economic trends, interest rates, and overall investor sentiment can indeed impact the performance of blue-chip stocks.