Embark on a journey to understanding blue-chip stocks with a focus on evaluating them effectively. Dive into key metrics, market position, and growth potential in this insightful exploration.

BLUE-CHIP STOCK

Blue-chip stocks are shares of large, well-established companies with a history of stable earnings and strong financials. These companies are industry leaders, have a solid reputation, and are known for their reliability. Investors often consider blue-chip stocks as safe investments due to their track record of consistent performance even during market downturns.

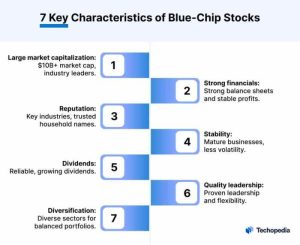

Characteristics of Blue-Chip Stocks:

- Large market capitalization

- Stable dividend payments

- Long history of profitability

- Resilient during economic downturns

Examples of Well-Known Blue-Chip Stocks:

- Apple Inc. (AAPL)

- Microsoft Corporation (MSFT)

- The Coca-Cola Company (KO)

- Johnson & Johnson (JNJ)

Historical Performance of Blue-Chip Stocks:

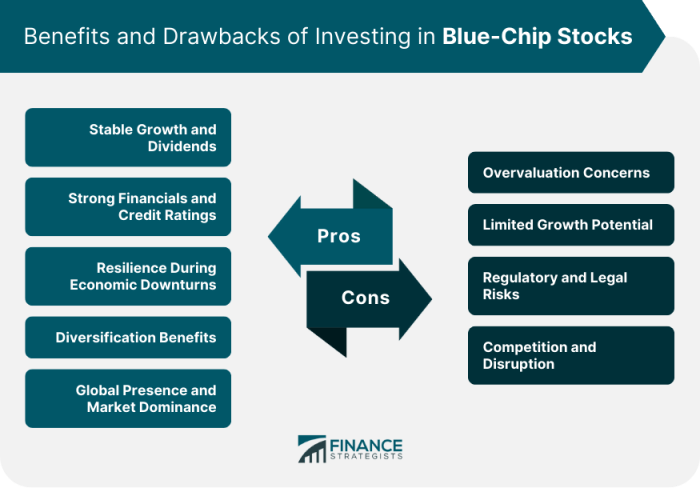

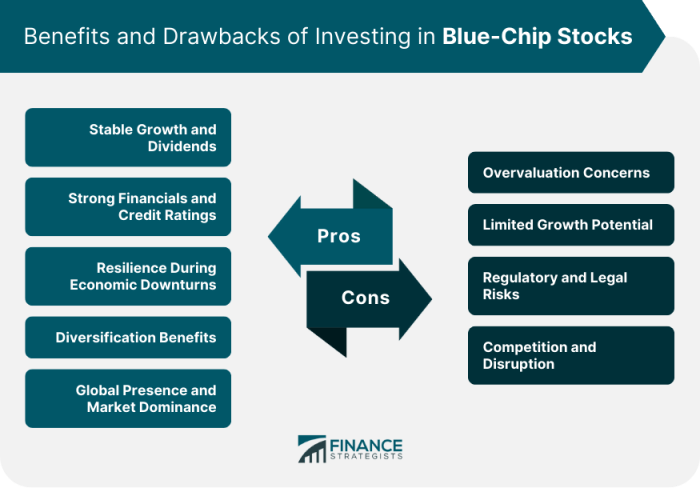

Blue-chip stocks have demonstrated stable growth and have outperformed other types of stocks over the long term. Their consistent earnings and dividends attract investors seeking a reliable source of income and capital appreciation. The stability and reputation of these companies make them less volatile compared to smaller companies or growth stocks.

Why Investors Consider Blue-Chip Stocks as Safe Investments:

- Lower risk due to established track record

- Less volatility in stock price movements

- Reliable dividend payments

- Perceived as less susceptible to economic downturns

HOW TO EVALUATE BLUE-CHIP STOCKS

When evaluating blue-chip stocks, it is important to consider various key financial metrics that can provide valuable insights into the company’s performance and stability. These metrics can help investors make informed decisions about whether a particular blue-chip stock is a good investment opportunity.

Identify Key Financial Metrics

- Revenue growth: Look at the company’s revenue growth over time to assess its ability to generate income.

- Profit margins: Analyze the company’s profit margins to understand its profitability and efficiency.

- Debt-to-equity ratio: Consider the company’s debt levels in relation to its equity to evaluate its financial leverage.

- Price-to-earnings ratio (P/E): Evaluate the company’s stock price relative to its earnings to determine its valuation.

Analyzing Market Position and Competitive Advantage

- Market dominance: Examine the company’s market share and competitive position in its industry.

- Barriers to entry: Assess the barriers that protect the company’s market position from competitors.

- Innovation and R&D: Look at the company’s investment in research and development to maintain a competitive edge.

Assessing the Management Team

- Experience and track record: Evaluate the qualifications and past performance of the company’s management team.

- Strategic vision: Consider the management team’s long-term strategy and ability to adapt to changing market conditions.

- Corporate governance: Review the company’s governance structure to ensure transparency and accountability.

Evaluating Long-Term Growth Potential

- Industry trends: Analyze the industry trends and market conditions that could impact the company’s growth prospects.

- Business expansion: Look at the company’s plans for expansion and diversification to assess its growth potential.

- Dividend history: Consider the company’s dividend history as an indicator of its financial strength and commitment to shareholders.

In conclusion, mastering the evaluation of blue-chip stocks is paramount for investors seeking stable and long-term growth. Keep analyzing, keep learning, and keep investing wisely.

Key Questions Answered

How can I identify key financial metrics for evaluating blue-chip stocks?

Key financial metrics include revenue growth, profit margins, return on equity, and debt-to-equity ratio.

Why is it important to assess a company’s market position when evaluating blue-chip stocks?

Understanding a company’s market position helps in predicting its future growth and competitive advantage in the industry.

What are some strategies for evaluating the long-term growth potential of blue-chip stocks?

Look for consistent revenue growth, strong competitive moat, innovative products/services, and global market presence.