Diving into the world of Blue-chip stocks with the best performance, this introduction sets the stage for an insightful exploration, offering a blend of informative content and engaging narrative that captivates the reader’s attention right from the start.

In the subsequent paragraph, readers will find comprehensive details and explanations about the topic at hand.

BLUE-CHIP STOCKS

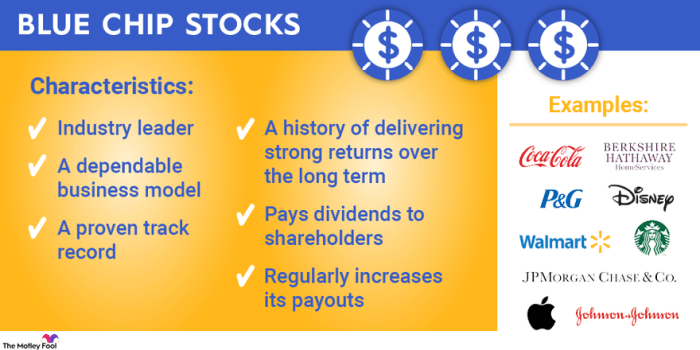

Blue-chip stocks are shares of well-established and financially stable companies that have a long history of consistent performance. These companies are typically leaders in their industry with a strong market presence, solid financials, and a history of paying dividends to their shareholders.

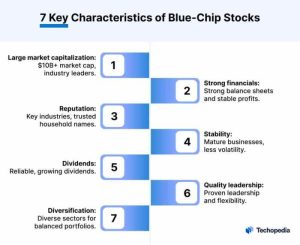

Characteristics of Blue-Chip Stocks

- Large market capitalization

- Strong balance sheet and cash flow

- History of stable earnings and revenue growth

- Low debt-to-equity ratio

- Regular dividend payments

- Resilience during economic downturns

Examples of Blue-Chip Stocks

Blue-chip stocks include companies like:

- Apple Inc. (AAPL)

-Known for its innovative products and strong sales performance. - Johnson & Johnson (JNJ)

-A healthcare giant with a diversified product portfolio. - The Coca-Cola Company (KO)

-A global leader in the beverage industry. - Microsoft Corporation (MSFT)

-A technology powerhouse with a history of consistent growth.

These companies have displayed resilience and stability in the market, making them attractive options for long-term investors looking for reliable returns.

BEST PERFORMANCE METRICS

When evaluating the performance of blue-chip stocks, there are several key performance metrics that investors commonly look at. These metrics help assess the financial health and potential growth of a company, guiding investment decisions.Price-to-Earnings Ratio (P/E Ratio):The price-to-earnings ratio is a widely used metric that compares a company’s current stock price to its earnings per share (EPS). A high P/E ratio may indicate that investors expect high future growth, while a low P/E ratio could suggest the stock is undervalued.

It’s essential to consider industry norms and compare P/E ratios across companies within the same sector for a meaningful analysis.Dividend Yield:Dividend yield is another crucial metric that measures the annual dividend payment as a percentage of the stock’s current price. Companies that consistently pay dividends and have a high dividend yield are often seen as stable investments, particularly for income-seeking investors.

However, a very high dividend yield could signal financial distress or an unsustainable payout ratio.Market Capitalization:Market capitalization, or market cap, is calculated by multiplying the total number of outstanding shares by the current stock price. It reflects the total value of a company in the stock market and is a key indicator of a company’s size and importance. Blue-chip stocks typically have large market capitalizations, indicating stability and a proven track record of success.

Price-to-Earnings Ratio

The price-to-earnings ratio (P/E ratio) is a fundamental metric that provides insight into a company’s valuation relative to its earnings. A high P/E ratio may suggest that investors are willing to pay a premium for future growth potential, while a low P/E ratio could indicate an undervalued stock. It’s essential to consider the industry average and compare P/E ratios across companies within the same sector for a meaningful analysis.

Dividend Yield

Dividend yield is a critical metric for income-seeking investors, as it measures the annual dividend payment relative to the stock price. A high dividend yield indicates that a company pays out a significant portion of its earnings to shareholders as dividends. However, investors should also consider the sustainability of the dividend payout ratio and the company’s ability to maintain or grow dividends over time.

Market Capitalization

Market capitalization reflects the total value of a company’s outstanding shares in the stock market. Companies with large market capitalizations are typically considered more stable and less volatile, making them attractive investments for risk-averse investors. Blue-chip stocks are known for their large market capitalizations, indicating their established presence in the market and potential for long-term growth.

FACTORS AFFECTING PERFORMANCE

Blue-chip stocks are not immune to market forces and external factors that can influence their performance. Understanding these factors is crucial for investors looking to make informed decisions.

Economic Conditions

Economic conditions play a significant role in the performance of blue-chip stocks. Factors such as interest rates, inflation, GDP growth, and unemployment rates can impact stock prices. For example, during periods of economic recession, blue-chip stocks may underperform due to decreased consumer spending and corporate earnings.

Industry Trends

Industry trends also have a considerable influence on the performance of blue-chip stocks. Changes in technology, consumer preferences, regulations, and competition can affect stock prices. For instance, a shift towards renewable energy sources could boost the performance of blue-chip stocks in the clean energy sector.

Company-Specific News

Company-specific news, such as earnings reports, product launches, mergers, and acquisitions, can have a direct impact on the stock price of blue-chip companies. Positive news can lead to a surge in stock prices, while negative news can trigger a decline. For example, a pharmaceutical company announcing a breakthrough drug could result in a significant increase in its stock price.

STRATEGIES FOR INVESTING

Investing in blue-chip stocks requires careful consideration and strategic planning to maximize returns and minimize risks. Whether you prefer a buy-and-hold approach or an active trading strategy, understanding the different investment strategies can help you make informed decisions to achieve optimal performance in your portfolio.

Buy-and-Hold Strategy

The buy-and-hold strategy involves purchasing blue-chip stocks with the intention of holding onto them for an extended period, typically years or even decades. This strategy is based on the belief that high-quality companies will continue to grow and provide consistent returns over time. Investors following this approach focus on the long-term outlook of the companies and are less concerned with short-term market fluctuations.

Active Trading Strategy

On the other hand, an active trading strategy involves buying and selling blue-chip stocks frequently to capitalize on short-term price movements. This approach requires investors to closely monitor market trends, company news, and economic indicators to make timely trading decisions. Active traders aim to profit from market volatility and may use technical analysis or other trading tools to identify opportunities for buying or selling.

Building a Diversified Portfolio

Building a diversified portfolio of blue-chip stocks is essential for long-term growth and risk management. Diversification involves spreading your investments across different sectors, industries, and asset classes to reduce the impact of market fluctuations on your overall portfolio. By investing in a mix of blue-chip stocks with varying performance metrics and market capitalizations, you can minimize the risk of significant losses and potentially increase your chances of achieving consistent returns over time.

Concluding our discussion on Blue-chip stocks with the best performance, this section provides a compelling summary that encapsulates the key points and leaves a lasting impact on the reader.

Query Resolution

What are Blue-chip stocks?

Blue-chip stocks are shares of large, well-established companies with a history of stable earnings and reliable performance.

How do performance metrics like price-to-earnings ratio affect Blue-chip stocks?

The price-to-earnings ratio is one of the key metrics used to evaluate Blue-chip stocks, reflecting the company’s earnings relative to its stock price.

What external factors can impact the performance of Blue-chip stocks?

External factors such as economic conditions, industry trends, and company-specific news can influence the performance of Blue-chip stocks.

What are some strategies for investing in Blue-chip stocks?

Investors can opt for buy-and-hold strategies or active trading strategies when dealing with Blue-chip stocks, aiming for long-term growth and portfolio diversification.