Delving into the realm of Blue-chip stocks with strong fundamentals, this captivating introduction sets the stage for a journey filled with valuable insights and in-depth analysis, promising a rewarding read for all investors seeking stability and growth in their portfolios.

Exploring the essence of blue-chip stocks and their fundamental strengths, this guide aims to equip readers with the necessary knowledge to make informed investment decisions in the ever-evolving market landscape.

Blue-Chip Stocks

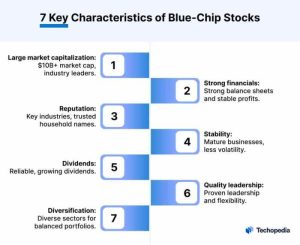

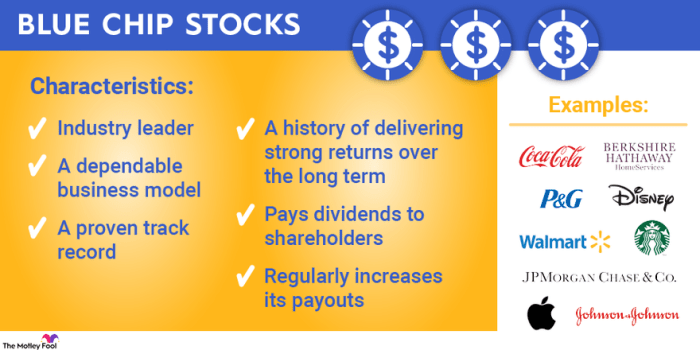

Blue-chip stocks are shares of large, well-established companies with a history of stable earnings and reliable performance. These companies are typically leaders in their respective industries and have a long track record of success.

Investors consider blue-chip stocks as stable investments due to their strong fundamentals, including solid financials, consistent dividend payments, and a reputation for weathering market downturns. These stocks are often less volatile than other types of investments, making them a popular choice for risk-averse investors looking for long-term growth and income.

Examples of Blue-Chip Stocks

- Apple Inc. (AAPL)

- Microsoft Corporation (MSFT)

- The Coca-Cola Company (KO)

- Johnson & Johnson (JNJ)

- Procter & Gamble Company (PG)

Fundamentals of Blue-Chip Stocks

When it comes to evaluating blue-chip stocks, understanding the fundamentals is crucial. Strong fundamentals are essentially the financial health and stability of a company, which can indicate its potential for long-term growth and success in the stock market.

What Constitutes Strong Fundamentals

Fundamental analysis involves looking at various aspects of a company, such as its revenue, earnings, cash flow, debt levels, and growth prospects. A company with strong fundamentals typically has consistent revenue and earnings growth, a healthy balance sheet with manageable debt levels, and a solid business model that can withstand market fluctuations.

Evaluating the Fundamental Strength of Blue-Chip Stocks

To evaluate the fundamental strength of a blue-chip stock, investors can look at key financial ratios like the price-to-earnings (P/E) ratio, price-to-book (P/B) ratio, return on equity (ROE), and debt-to-equity ratio. These ratios can provide insights into the company’s valuation, profitability, efficiency, and financial health. Additionally, analyzing the company’s competitive position, industry trends, and management team can also help assess its long-term potential.

Significance of Strong Fundamentals for Long-Term Investment Success

Strong fundamentals are essential for long-term investment success because they indicate a company’s ability to generate sustainable growth and profitability over time. Companies with strong fundamentals are more likely to weather economic downturns, attract investors, and deliver consistent returns. By focusing on blue-chip stocks with strong fundamentals, investors can build a diversified portfolio that is positioned for long-term growth and stability in the stock market.

Financial Metrics for Analysis

When evaluating blue-chip stocks, there are several key financial metrics that investors use to assess the strength and stability of these companies. These metrics provide valuable insights into the financial health of a company and help investors make informed decisions about their investments.

Revenue Growth

Revenue growth is a crucial metric that indicates how well a company is expanding its business and increasing its top line. Investors look at the year-over-year revenue growth to assess the company’s ability to generate more sales and potentially higher profits in the future. A consistent and healthy revenue growth trend is often a positive sign for blue-chip stocks.

Profit Margin

Profit margin is another important metric that measures the company’s profitability. It is calculated by dividing the net income by total revenue and is expressed as a percentage. A higher profit margin indicates that the company is efficient in managing its costs and generating profits from its operations. Blue-chip stocks with strong profit margins are generally more attractive to investors.

Debt-to-Equity Ratio

The debt-to-equity ratio is a financial leverage ratio that compares a company’s total debt to its shareholders’ equity. It provides insights into how much debt a company is using to finance its operations compared to its equity. A lower debt-to-equity ratio is often preferred as it indicates that the company is less reliant on debt financing, which can be risky during economic downturns.

Price-to-Earnings (P/E) Ratio

The price-to-earnings ratio is a valuation metric that compares the company’s current stock price to its earnings per share (EPS). It helps investors understand how much they are paying for each dollar of earnings generated by the company. A lower P/E ratio may indicate that the stock is undervalued, while a higher P/E ratio could suggest that the stock is overvalued.

Return on Equity (ROE)

Return on equity is a profitability ratio that measures the company’s ability to generate profits from the shareholders’ equity. It is calculated by dividing net income by shareholders’ equity and is expressed as a percentage. A high ROE indicates that the company is effectively utilizing the shareholders’ funds to generate profits, making it an attractive investment option.

Market Performance and Trends

Investors often analyze historical market performance trends of blue-chip stocks to make informed decisions. Understanding how market conditions impact the performance of these stocks is crucial for maximizing returns. By tracking market trends, investors can gain valuable insights to navigate the stock market effectively.

Historical Market Performance Trends

Blue-chip stocks are known for their stability and strong fundamentals, which typically result in consistent long-term performance. By analyzing historical data, investors can identify patterns and trends that may indicate future performance. For example, a stock that has shown steady growth over the years may be a reliable investment option for those seeking stability in their portfolio.

Impact of Market Conditions

Market conditions play a significant role in determining the performance of blue-chip stocks. Factors such as economic indicators, geopolitical events, and industry trends can influence stock prices. For instance, during times of economic uncertainty, blue-chip stocks may outperform other types of investments due to their established track record and financial stability.

Using Market Trends to Your Advantage

Investors can leverage market trends to their advantage when investing in blue-chip stocks by identifying opportunities for growth and potential risks. By staying informed about market developments and analyzing historical data, investors can make more informed decisions about when to buy or sell stocks. Additionally, monitoring key financial metrics and indicators can help investors spot trends early and adjust their investment strategy accordingly.

As we reach the conclusion of this exploration into Blue-chip stocks with strong fundamentals, a rich tapestry of information unfolds, leaving investors with a clear understanding of the importance of solid fundamentals in achieving long-term investment success.

Questions Often Asked

What sets blue-chip stocks apart from other types of investments?

Blue-chip stocks are well-established companies with a history of stable earnings and reliable performance, making them less volatile compared to other investment options.

How can investors assess the fundamental strength of a blue-chip stock?

Investors can evaluate factors such as revenue growth, profitability, and market position to gauge the fundamental strength of a blue-chip stock.

Which key financial metrics are crucial for analyzing blue-chip stocks?

Financial metrics like price-to-earnings ratio (P/E), return on equity (ROE), and debt-to-equity ratio are essential for assessing the strength of blue-chip stocks.

How do market trends influence the performance of blue-chip stocks?

Market trends reflect investor sentiment and economic conditions, impacting the stock prices of blue-chip companies accordingly.