Blue-chip stocks with consistent growth sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. It dives into the world of stable investments and strategies for long-term growth, providing a comprehensive guide for investors seeking reliable returns in the stock market.

As we delve deeper into the characteristics of blue-chip stocks and the factors driving their consistent growth, readers will gain valuable insights into the dynamics of these top-tier investments and how they stack up against other stock categories.

BLUE-CHIP STOCKS

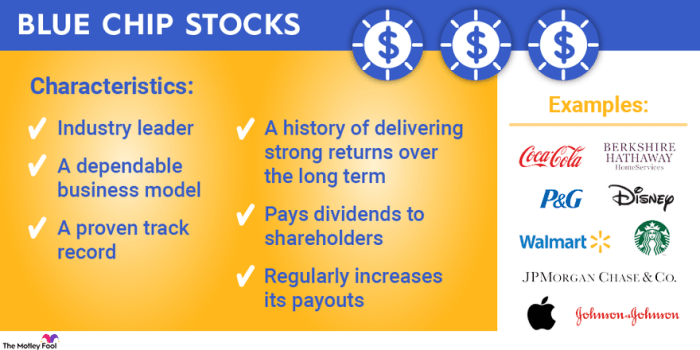

Blue-chip stocks are shares of large, well-established companies with a history of stable earnings and a strong financial position. These companies are typically leaders in their respective industries, have a long track record of success, and are considered to be relatively safe investments.Blue-chip stocks are often seen as stable investments due to their consistent performance, reliable dividends, and ability to weather economic downturns.

Investors are attracted to these stocks for their lower risk compared to smaller, growth-oriented companies.Some examples of well-known blue-chip stocks include companies like Apple Inc., Microsoft Corporation, Johnson & Johnson, and The Coca-Cola Company. These companies have a global presence, strong brand recognition, and a history of delivering steady returns to investors.Historically, blue-chip stocks have outperformed other types of stocks during turbulent market conditions.

Investors tend to flock to these stable companies during times of uncertainty, seeking safety and reliability in their investment portfolios. While blue-chip stocks may not offer the same explosive growth potential as smaller companies, they provide a sense of security and long-term growth for investors.

CONSISTENT GROWTH

Consistent growth in the context of stocks refers to a steady increase in value over time, without significant fluctuations or declines. This type of growth is desirable for investors as it indicates stability and reliability in the performance of a stock.

Identifying Blue-Chip Stocks with Consistent Growth Potential

When looking for blue-chip stocks with consistent growth potential, investors often focus on companies with a long track record of success, solid financial performance, and a history of paying dividends. These stocks are typically found in well-established industries and have a strong competitive advantage in the market.

- Look for companies with a history of stable earnings growth over several years.

- Consider the company’s market position and competitive advantage to assess its ability to maintain growth.

- Analyze the company’s financial statements, including revenue growth, profit margins, and return on equity.

- Pay attention to dividend history and sustainability, as consistent dividend payments can indicate a financially healthy company.

Factors Contributing to Consistent Growth of Blue-Chip Stocks

Several factors contribute to the consistent growth of blue-chip stocks, including:

- Strong market position and competitive advantage that allow the company to maintain profitability even in challenging market conditions.

- Stable and diversified revenue streams that reduce the impact of economic downturns or industry-specific risks.

- Effective management and strategic decision-making that drive long-term growth and value creation for shareholders.

- Continuous innovation and adaptation to changing market trends to stay ahead of the competition.

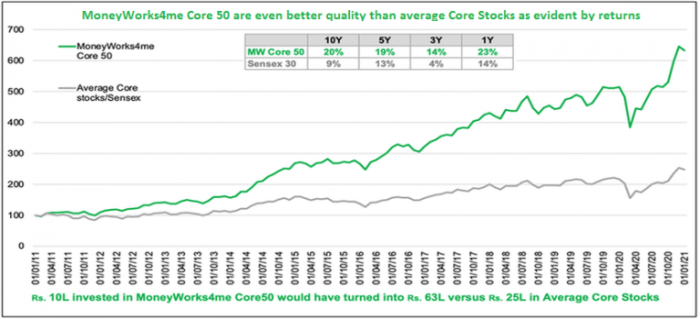

Comparison of Growth Patterns in Blue-Chip Stocks vs. Other Stock Categories

Blue-chip stocks typically exhibit more stable and predictable growth patterns compared to other stock categories, such as small-cap or mid-cap stocks. While these stocks may offer higher growth potential, they also come with higher volatility and risk. On the other hand, blue-chip stocks are known for their consistent performance and ability to deliver steady returns over the long term.

INVESTMENT STRATEGIES

Investing in blue-chip stocks with consistent growth requires careful consideration and strategic planning to maximize returns while minimizing risks. Diversification, long-term perspective, and market conditions play crucial roles in shaping a successful investment strategy in this area.

Diversification in Blue-Chip Stock Portfolio

Diversifying your portfolio with a mix of different blue-chip stocks across various industries can help reduce risk exposure. By spreading your investments, you can mitigate the impact of a downturn in a specific sector or company on your overall portfolio. It is essential to select companies with strong fundamentals and proven track records to ensure stability and growth potential.

Tips for Long-Term Investors

- Focus on companies with a history of consistent growth and profitability.

- Monitor the performance of your investments regularly but avoid making impulsive decisions based on short-term market fluctuations.

- Reinvest dividends to take advantage of compounding returns over time.

- Stay informed about market trends and economic indicators that could affect the growth of blue-chip stocks.

- Consider dollar-cost averaging as a strategy to invest consistently over time, regardless of market conditions.

Impact of Market Conditions

Market conditions, such as economic growth, interest rates, and geopolitical events, can significantly influence the performance of blue-chip stocks. In times of economic uncertainty, investors may seek refuge in stable companies with strong balance sheets and reliable dividends. Understanding how these external factors can impact the growth potential of blue-chip stocks is essential for making informed investment decisions.

RISK MANAGEMENT

When it comes to investing in blue-chip stocks, risk management plays a crucial role in protecting your investments and maximizing returns. By understanding the potential risks associated with holding blue-chip stocks, investors can implement strategies to mitigate these risks effectively.

Risk management techniques for investors holding blue-chip stocks

- Diversification: One of the most common risk management techniques is diversifying your investment portfolio. By spreading your investments across different sectors and industries, you can reduce the impact of a downturn in any single stock.

- Setting stop-loss orders: Setting stop-loss orders can help investors limit their losses by automatically selling a stock if it reaches a predetermined price.

- Regular monitoring: Keeping a close eye on your investments and staying informed about market trends and company performance can help you make informed decisions and react promptly to any changes.

Comparing risk profiles of blue-chip stocks with growth stocks and value stocks

- Blue-chip stocks are known for their stability and consistent growth over time, making them less risky compared to growth stocks, which are more volatile and can experience sudden price fluctuations.

- On the other hand, value stocks are typically undervalued by the market, offering the potential for high returns but also come with higher risks due to uncertainties surrounding their future performance.

- Overall, blue-chip stocks are considered safer investments due to their strong track record and established market presence.

Examples of unexpected risks that could impact the growth of blue-chip stocks

- Regulatory changes: Changes in government regulations or policies can have a significant impact on blue-chip stocks, affecting their profitability and growth prospects.

- Market disruptions: Unexpected events such as natural disasters, geopolitical tensions, or economic downturns can disrupt the market and cause fluctuations in the prices of blue-chip stocks.

- Competition: Increased competition from new entrants or existing competitors can pose a threat to the market share and profitability of blue-chip companies, impacting their growth potential.

In conclusion, blue-chip stocks with consistent growth present a compelling opportunity for investors looking to build a strong portfolio over time. By understanding the nuances of these dependable investments and implementing effective strategies, individuals can navigate the market with confidence and secure their financial future with ease.

User Queries

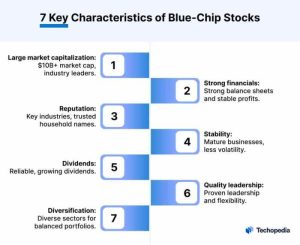

What are the key characteristics of blue-chip stocks?

Blue-chip stocks are typically large, well-established companies with a history of stable performance, strong balance sheets, and a track record of consistent dividend payments.

How can investors identify blue-chip stocks with consistent growth potential?

Investors can look for companies with strong brand recognition, competitive advantages, solid financials, and a history of increasing earnings and dividends over time.

Why is diversification important when investing in blue-chip stocks?

Diversification helps spread risk across different assets and industries, reducing the impact of a downturn in any single stock on the overall portfolio.

What risk management techniques can investors use for holding blue-chip stocks?

Investors can employ strategies like setting stop-loss orders, regularly reviewing their portfolio, and staying informed about market trends and company performance.

How do market conditions affect the growth of blue-chip stocks?

Market conditions such as economic indicators, interest rates, and geopolitical events can influence investor sentiment and impact the performance of blue-chip stocks.