Starting with Blue-chip stocks vs growth stocks, the discussion delves into the distinctions between these investment options, shedding light on their unique characteristics and appeal.

As we explore the differences in risk levels, historical performance, and investor perceptions, a comprehensive understanding of blue-chip and growth stocks emerges.

Blue-Chip Stocks vs Growth Stocks

When it comes to investing in the stock market, two common types of stocks that investors often come across are blue-chip stocks and growth stocks. Understanding the differences between these two types of stocks is crucial for making informed investment decisions.

Definition of Blue-Chip Stocks and Growth Stocks

Blue-chip stocks are shares of large, well-established companies with a history of stable earnings and a solid reputation in the market. These companies are typically industry leaders with a long track record of success, making them a reliable choice for investors seeking stability and consistent returns.

Growth stocks, on the other hand, are shares of companies that are expected to grow at a faster rate than the overall market. These companies are often in the early stages of development and reinvest most of their earnings back into the business to fuel expansion. Growth stocks have the potential for significant capital appreciation but also come with higher levels of risk due to their volatile nature.

Key Differences between Blue-Chip Stocks and Growth Stocks

- Blue-chip stocks offer stability and consistent dividend payments, while growth stocks focus on capital appreciation through reinvested earnings.

- Blue-chip stocks are less volatile and generally have lower risk compared to growth stocks, which can experience significant price fluctuations.

- Investors with a conservative investment approach often prefer blue-chip stocks, while those seeking higher returns may opt for growth stocks.

Risk Levels Associated with Investing in Blue-Chip Stocks versus Growth Stocks

Investing in blue-chip stocks is considered less risky due to the stability and long-standing reputation of the companies. These stocks are less likely to experience drastic price swings, making them a safer option for risk-averse investors.

On the other hand, investing in growth stocks carries higher risk due to their volatile nature and dependency on future growth prospects. While growth stocks have the potential for substantial gains, they also come with the risk of significant losses if the company fails to meet growth expectations.

Historical Performance of Blue-Chip Stocks compared to Growth Stocks

Historically, blue-chip stocks have shown steady performance over the long term, providing investors with reliable returns and consistent dividend payments. These stocks are known for weathering market downturns and economic uncertainties better than growth stocks.

On the contrary, growth stocks have the potential for rapid growth and higher returns in a shorter period. However, they are more susceptible to market fluctuations and economic downturns, leading to greater volatility in their performance compared to blue-chip stocks.

Blue-Chip Stocks

Blue-chip stocks are shares of large, well-established companies with a history of stable performance and reliable earnings. These companies are leaders in their respective industries and have a reputation for quality, longevity, and financial stability.

Definition and Examples

- Some examples of well-known blue-chip stocks include Apple Inc. (AAPL), Microsoft Corporation (MSFT), Johnson & Johnson (JNJ), and The Coca-Cola Company (KO).

- These companies are typically part of the Dow Jones Industrial Average or the S&P 500 index, which are benchmarks for the overall stock market.

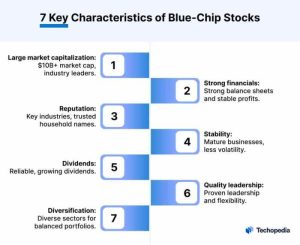

Characteristics

- Blue-chip stocks are known for their consistent dividend payments, which provide investors with a steady income stream.

- They have a history of weathering economic downturns and market volatility, making them less risky investments compared to smaller, growth-oriented companies.

- These stocks tend to have strong balance sheets, low debt levels, and a track record of profitability, which instills confidence in investors.

Stability and Investor Appeal

- Investors often consider blue-chip stocks to be more stable investments due to their established track record and market presence.

- During periods of market uncertainty, blue-chip stocks are perceived as safer havens, providing a sense of security and reliability.

- Many investors view blue-chip stocks as a core component of a diversified portfolio, offering a balance of growth potential and stability.

Concluding our exploration of Blue-chip stocks vs growth stocks, it becomes evident that each type offers distinct advantages and considerations for investors, shaping their investment strategies and preferences.

Essential Questionnaire

What are blue-chip stocks?

Blue-chip stocks refer to shares of well-established companies with a history of stable performance and reliable dividends.

How do growth stocks differ from blue-chip stocks?

Growth stocks are shares of companies with high potential for earnings growth, often reinvesting their profits for expansion rather than paying dividends.

Which type of stock is considered riskier?

Growth stocks are generally perceived as riskier due to their higher volatility and potential for greater price fluctuations.