With Blue-chip stocks in the tech industry at the forefront, this paragraph opens a window to an amazing start and intrigue, inviting readers to embark on a storytelling casual formal language style filled with unexpected twists and insights.

Blue-chip stocks are known for their stability and long-term growth potential, making them a popular choice for investors looking for reliable investments. In the tech industry, these stocks play a crucial role in portfolios, offering exposure to leading tech companies with proven track records. Let’s explore the world of Blue-chip stocks in the tech sector and uncover the secrets to successful investing.

Blue-Chip Stocks

Blue-Chip stocks are large, well-established companies with a history of stable performance and reliable earnings. These stocks are considered to be some of the most secure investments in the market due to their strong financials and market presence.

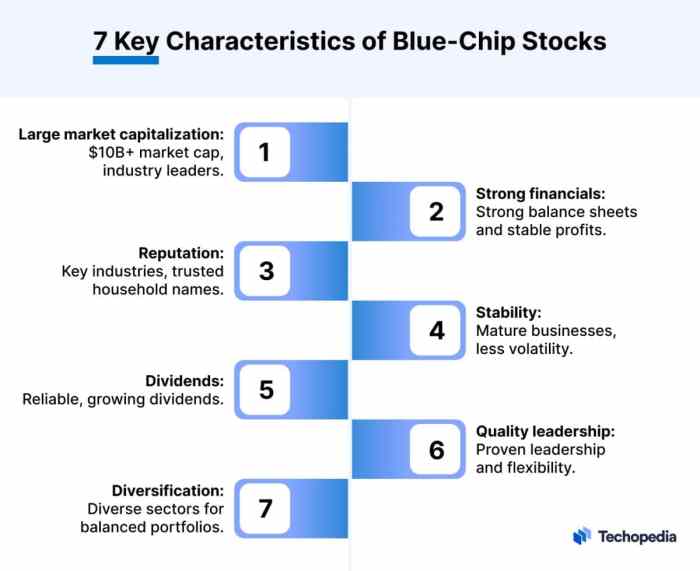

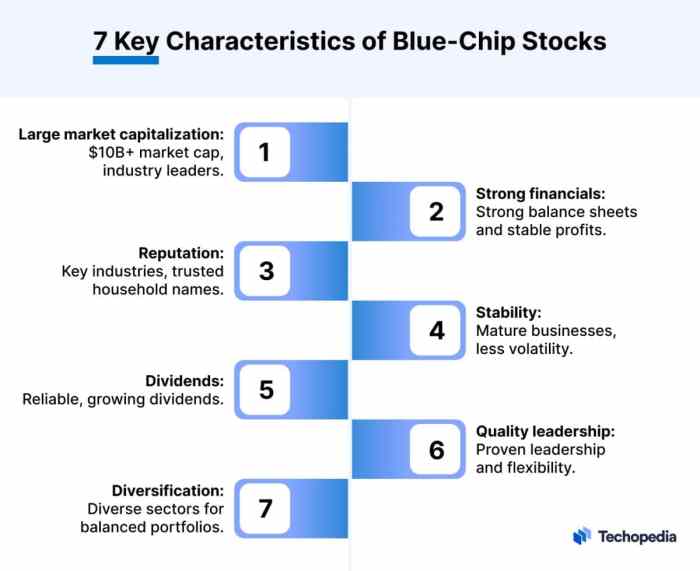

Characteristics of Blue-Chip Stocks

- Long history of stable performance

- Strong market presence and brand recognition

- Consistent dividend payments

- Large market capitalization

Examples of Blue-Chip Stocks

- Apple Inc. (AAPL)

-Technology Industry - Johnson & Johnson (JNJ)

-Healthcare Industry - The Coca-Cola Company (KO)

-Consumer Goods Industry - Exxon Mobil Corporation (XOM)

-Energy Industry

Significance of Investing in Blue-Chip Stocks

Blue-Chip stocks are often seen as a safe haven for investors looking for long-term stability in their portfolios. These stocks have a proven track record of weathering market downturns and providing consistent returns over time. Additionally, their large market capitalization and brand recognition make them less susceptible to volatility compared to smaller companies. Investing in Blue-Chip stocks can provide stability and steady growth to an investment portfolio.

Blue-Chip Stocks in the Tech Industry

Blue-Chip stocks in the tech industry represent some of the most stable and reliable investments available in the stock market. These companies are well-established, financially sound, and have a track record of consistent performance.

Top Blue-Chip Tech Stocks

Some of the top Blue-Chip tech stocks currently in the market include:

- Apple Inc. (AAPL)

- Microsoft Corporation (MSFT)

- Alphabet Inc. (GOOGL)

- Amazon.com Inc. (AMZN)

- Facebook, Inc. (FB)

Reasons for Considering Tech Companies as Blue-Chip Stocks

Tech companies are often considered Blue-Chip stocks due to their strong market presence, innovative products, and consistent revenue growth. These companies have a history of adapting to changing market trends and maintaining their competitive edge.

Comparison with Blue-Chip Stocks in Other Industries

Compared to Blue-Chip stocks in other industries, tech Blue-Chip stocks tend to have higher volatility but also offer greater growth potential. Tech companies are known for their ability to disrupt traditional industries and create new markets, making them attractive long-term investments for many investors.

Investment Strategy with Blue-Chip Tech Stocks

Investing in Blue-Chip tech stocks can be a lucrative opportunity for investors looking for stability and long-term growth in their portfolios. However, it is essential to have a well-thought-out investment strategy to navigate the complexities of the tech industry and minimize risks.

Strategies for Investing in Blue-Chip Tech Stocks

- Research the company: Before investing in any Blue-Chip tech stock, conduct thorough research on the company’s financial health, market position, and growth prospects.

- Long-term perspective: Blue-Chip tech stocks are best suited for long-term investors who can withstand market volatility and capitalize on the sector’s growth potential.

- Dollar-cost averaging: Consider employing a dollar-cost averaging strategy to mitigate the impact of market fluctuations by consistently investing a fixed amount at regular intervals.

- Monitor market trends: Stay informed about industry trends, technological advancements, and macroeconomic factors that could influence the performance of tech stocks.

Risks Associated with Investing in Tech Blue-Chip Stocks

- Volatility: The tech sector is known for its volatility, with stock prices often experiencing significant fluctuations in response to market conditions and company performance.

- Regulatory challenges: Tech companies are subject to regulatory scrutiny, which can impact their operations and profitability.

- Competition: Intense competition within the tech industry can erode market share and profitability for Blue-Chip tech companies.

- Technological disruptions: Rapid technological advancements can render existing products or services obsolete, posing a risk to tech companies’ long-term viability.

Diversification with Tech Blue-Chip Stocks in a Portfolio

- Include a mix of tech and non-tech assets: Diversifying your portfolio with both tech and non-tech assets can help reduce overall risk exposure and enhance long-term returns.

- Spread investments across sectors: Allocate investments across different tech sub-sectors to minimize concentration risk and capitalize on diverse growth opportunities.

- Rebalance regularly: Periodically rebalance your portfolio to ensure that your asset allocation aligns with your risk tolerance and investment goals.

When to Buy, Hold, or Sell Blue-Chip Tech Stocks

- Buy: Consider buying Blue-Chip tech stocks when they are undervalued relative to their growth potential and when market conditions present a buying opportunity.

- Hold: Hold onto Blue-Chip tech stocks during market fluctuations if the fundamental outlook of the company remains strong and aligns with your long-term investment goals.

- Sell: Sell Blue-Chip tech stocks if there are significant changes in the company’s fundamentals, market conditions deteriorate, or if better investment opportunities arise elsewhere.

Performance and Growth of Blue-Chip Tech Stocks

Blue-chip tech stocks have a long history of delivering impressive performance and growth in the stock market. These companies are known for their stability, strong financials, and consistent innovation in the tech sector.

Historical Performance of Leading Blue-Chip Tech Stocks

- Companies like Apple, Microsoft, Amazon, and Google have shown remarkable growth over the years, with their stock prices steadily increasing.

- Investors have reaped substantial returns by holding onto these blue-chip tech stocks for the long term.

- Despite occasional market fluctuations, these companies have demonstrated resilience and continued to outperform the broader market.

Growth Trends in the Tech Sector

- The tech sector is constantly evolving, with new innovations shaping the industry and driving growth opportunities for blue-chip tech stocks.

- Trends like cloud computing, artificial intelligence, and e-commerce have contributed to the success of tech giants and their stocks.

- Companies that can adapt to changing consumer preferences and technological advancements are likely to experience sustained growth in the future.

Impact of Market Conditions on Blue-Chip Tech Stocks

- Market conditions, such as economic downturns or geopolitical events, can influence the growth potential of blue-chip tech stocks.

- Volatility in the stock market may affect the performance of these stocks in the short term, but their strong fundamentals often help them weather the storm.

- Investors need to consider external factors when evaluating the growth prospects of blue-chip tech stocks and make informed decisions based on market conditions.

Success Stories and Challenges Faced by Tech Blue-Chip Stocks

- Companies like Apple and Microsoft have faced challenges in the past, such as competition, regulatory issues, and changing consumer preferences, but have managed to overcome them and maintain their status as blue-chip stocks.

- On the other hand, companies that failed to innovate or adapt to market trends have seen their stock prices decline and lost their blue-chip status.

- Investors can learn from the success stories and challenges faced by tech blue-chip stocks to make informed investment decisions and navigate the ever-changing tech landscape.

In conclusion, Blue-chip stocks in the tech industry present a compelling opportunity for investors seeking stability and growth. By understanding the characteristics and strategies associated with these stocks, investors can make informed decisions to build a strong portfolio. Whether you’re a seasoned investor or just starting out, incorporating Blue-chip tech stocks into your investment strategy can lead to long-term success in the ever-evolving tech landscape.

Questions and Answers

What sets Blue-Chip stocks apart from other types of stocks?

Blue-Chip stocks are well-established companies with a history of stable performance, strong financials, and a solid reputation in the market.

How can investors benefit from investing in Blue-Chip tech stocks?

Investing in Blue-Chip tech stocks provides exposure to leading tech companies with established track records, offering stability and growth potential in a dynamic market.

What role does diversification play when including tech Blue-Chip stocks in a portfolio?

Diversification helps spread risk across different assets, including tech Blue-Chip stocks, reducing the impact of volatility in any single investment.

When is the right time to buy, hold, or sell Blue-Chip tech stocks?

The decision to buy, hold, or sell Blue-Chip tech stocks should be based on individual financial goals, market conditions, and the performance of the specific companies in the portfolio.