Blue-chip stocks in the S&P 500 sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with casual formal language style and brimming with originality from the outset.

Blue-chip stocks are renowned for their stability and long-term growth potential, making them a popular choice among investors seeking reliable returns in the stock market. This article delves into the world of blue-chip stocks, exploring their characteristics, benefits, and why they are considered a safe haven during economic downturns.

Blue-Chip Stocks in the S&P 500

Blue-chip stocks are shares in large, well-established companies with a history of stable performance and reliable earnings. These stocks are considered stable investments due to their strong financials, market presence, and ability to weather economic downturns more effectively than other companies.Some examples of well-known blue-chip stocks in the S&P 500 include companies like Apple Inc. (AAPL), Microsoft Corporation (MSFT), Johnson & Johnson (JNJ), and The Coca-Cola Company (KO).

These companies have a long track record of success, strong brand recognition, and consistent dividend payments.

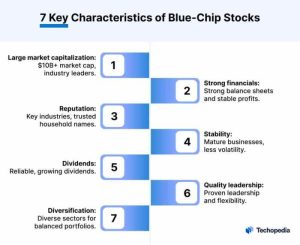

Criteria for Blue-Chip Stocks

Blue-chip stocks typically meet certain criteria to be classified as such. These criteria may include:

- Market Capitalization: Blue-chip stocks are usually companies with large market capitalizations, indicating their size and stability.

- History of Dividend Payments: These stocks often have a history of paying dividends to shareholders, demonstrating financial strength.

- Stable Earnings Growth: Blue-chip stocks generally have consistent earnings growth over time, showing their ability to generate profits even in challenging market conditions.

- Industry Leadership: These companies are often leaders in their respective industries, with a strong competitive advantage and market position.

Characteristics of Blue-Chip Stocks

Blue-chip stocks are known for their stable performance and strong fundamentals, making them a popular choice among investors looking for long-term growth and income. These stocks typically belong to well-established companies with a history of reliable earnings and dividends.

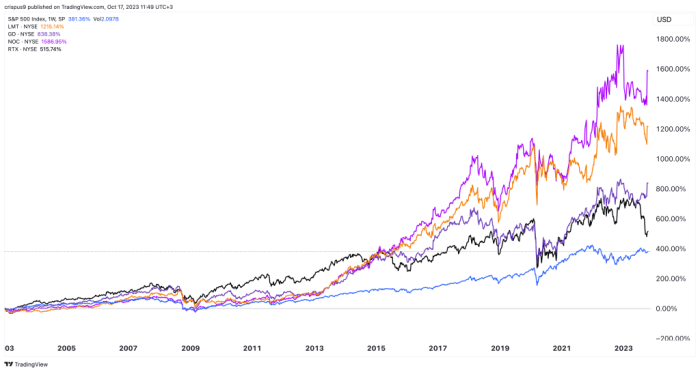

Performance During Market Fluctuations

Blue-chip stocks tend to weather market fluctuations better than other types of stocks due to their large market capitalization, strong balance sheets, and established market presence. Investors often turn to blue-chip stocks as a safe haven during times of market uncertainty, seeking stability and consistent returns.

Safe Haven During Economic Downturns

During economic downturns, investors often view blue-chip stocks as a safe haven due to their resilience and ability to maintain profitability even in challenging economic conditions. These stocks are perceived as less volatile and less likely to experience significant price swings compared to smaller or riskier investments.

Benefits of Investing in Blue-Chip Stocks

Investing in blue-chip stocks offers numerous advantages that make them attractive options for investors looking for stability and consistent returns over the long term. These well-established companies have a proven track record of success and are known for their strong financial performance, making them a reliable choice for many investors.

Stability and Consistent Returns

Blue-chip stocks are typically large, well-established companies with a history of stable performance. This stability can provide investors with a sense of security, especially during times of market volatility. Additionally, these companies often have a competitive advantage in their respective industries, which can lead to consistent returns over time.

Dividends and Capital Appreciation

One of the key benefits of investing in blue-chip stocks is the potential for dividends and capital appreciation. Many blue-chip companies pay dividends to their shareholders, providing a steady income stream. In addition, these companies have the potential for long-term capital appreciation, as their stock prices tend to increase steadily over time.

In conclusion, blue-chip stocks in the S&P 500 stand out as a cornerstone of any well-rounded investment portfolio, offering stability, consistent returns, and a sense of security during turbulent market conditions. By understanding the unique advantages of blue-chip stocks, investors can make informed decisions that align with their financial goals and risk tolerance.

Key Questions Answered

What are blue-chip stocks and why are they considered stable investments?

Blue-chip stocks are shares of well-established companies with a history of stable earnings and a strong market presence, making them less volatile compared to other stocks.

What criteria must a stock meet to be classified as a blue-chip stock?

To be classified as a blue-chip stock, a company should have a solid track record of performance, a strong balance sheet, and a history of paying consistent dividends.

How do blue-chip stocks perform during market fluctuations?

Blue-chip stocks tend to hold up better during market fluctuations due to their stable nature and strong financial position compared to other types of stocks.

What advantages do blue-chip stocks offer to investors?

Blue-chip stocks provide stability, consistent returns, dividends, and potential capital appreciation over the long term, making them attractive for risk-averse investors.