Exploring the realm of Blue-chip stocks for dividend income, this introduction sets the stage for an insightful discussion on how to generate reliable returns through strategic investment choices.

As we delve deeper, we will uncover the key criteria for selecting these top-tier stocks and understand their role in building a robust investment portfolio.

BLUE-CHIP STOCKS

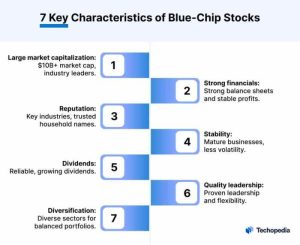

Blue-chip stocks are shares of well-established companies with a history of stable earnings and a strong reputation in the market. These stocks are considered to be reliable, safe investments due to their track record of consistent performance.Some characteristics that make a stock qualify as a blue-chip stock include a large market capitalization, a history of paying dividends, and being a leader in its industry.

Blue-chip stocks are typically part of major stock indices and have a proven track record of weathering economic downturns.

Examples of Well-Known Blue-Chip Stocks

- Apple Inc. (AAPL)

- Microsoft Corporation (MSFT)

- The Coca-Cola Company (KO)

- Johnson & Johnson (JNJ)

- Procter & Gamble Company (PG)

IMPORTANCE OF DIVIDEND INCOME

Dividend income is a crucial component for investors seeking to build a sustainable source of passive income. Unlike capital gains, which rely on selling stocks at a higher price than purchased, dividend income provides a steady stream of earnings that can be reinvested or used to cover expenses.In a balanced investment portfolio, dividend income plays a significant role in generating consistent returns and reducing overall risk.

By investing in dividend-paying stocks, investors can benefit from both the potential for stock price appreciation and regular cash payouts.

Benefits of Investing in Dividend-Paying Stocks

- Stability and Consistency: Companies that pay dividends tend to be more financially stable and have a history of consistent earnings, making them less volatile compared to non-dividend-paying stocks.

- Income Generation: Dividend income can provide a reliable source of passive income, especially for retirees or those looking to supplement their earnings.

- Reinvestment Opportunities: Reinvesting dividends through dividend reinvestment plans (DRIPs) can accelerate wealth accumulation through compounding returns over time.

- Historical Performance: Studies have shown that dividend-paying stocks have historically outperformed non-dividend-paying stocks, providing investors with attractive long-term returns.

BLUE-CHIP STOCKS FOR DIVIDEND INCOME

Blue-chip stocks are known for their stability and consistent dividend payments, making them attractive options for investors seeking reliable income streams. These stocks belong to well-established companies with a solid track record of performance and financial stability.

Specific Blue-Chip Stocks for Dividend Income

When it comes to blue-chip stocks for dividend income, some well-known names stand out. Companies like Johnson & Johnson, Procter & Gamble, Coca-Cola, and Exxon Mobil are often considered top choices for dividend investors. These companies have a history of paying dividends regularly and increasing them over time, making them reliable sources of income.

Comparing Dividend Yields

One way to evaluate blue-chip stocks for dividend income is by comparing their dividend yields. The dividend yield is calculated by dividing the annual dividend payment by the stock price. This ratio gives investors an idea of how much income they can expect to receive relative to the price they pay for the stock. Investors often look for stocks with higher dividend yields, as it indicates a higher return on their investment.

Criteria for Selecting Blue-Chip Stocks for Dividend Income

When selecting blue-chip stocks for dividend income, investors should consider various factors. Some key criteria to look at include the company’s history of dividend payments, the stability of its earnings, its ability to generate cash flow, and its dividend payout ratio. Additionally, investors may also consider the company’s growth prospects and overall financial health to ensure the sustainability of dividend payments in the long run.

In conclusion, Blue-chip stocks offer a stable source of dividend income, making them an essential component for investors seeking long-term financial growth. By carefully evaluating and selecting these stocks, one can create a solid foundation for a prosperous investment journey.

FAQ Resource

What are the key characteristics of blue-chip stocks?

Blue-chip stocks are typically large, well-established companies with a history of stable performance, strong financials, and a reliable dividend payment track record.

How do blue-chip stocks contribute to a balanced investment portfolio?

Blue-chip stocks provide stability and consistent returns, making them a crucial component of a diversified investment portfolio that aims to minimize risk.

What is the significance of dividend income for investors?

Dividend income offers a steady stream of cash flow, creating passive income for investors and serving as a reliable source of returns even during market downturns.

How can investors compare the dividend yield of different blue-chip stocks?

Investors can calculate the dividend yield by dividing the annual dividend per share by the stock price, allowing for a comparative analysis of dividend-paying potential across different blue-chip stocks.

What criteria should investors consider when selecting blue-chip stocks for dividend income?

Investors should focus on factors such as the company’s financial stability, dividend payout ratio, growth prospects, and the sustainability of dividend payments over time.