Embark on your investment journey with Blue-chip stocks for beginners, delving into the world of stable investments and potential growth opportunities. Learn how these top-tier stocks can benefit your portfolio.

Explore key factors to consider, risks to be aware of, and the overall significance of including blue-chip stocks in your investment strategy.

Introduction to Blue-Chip Stocks

Blue-chip stocks are shares of large, well-established companies with a history of stable earnings and reliable performance. These companies are typically market leaders in their respective industries and have a strong reputation for quality products or services. Blue-chip stocks are known for their stability, strong balance sheets, and consistent dividend payouts.Investing in blue-chip stocks is often considered a safe and conservative approach for beginners as these companies are less volatile compared to smaller or riskier investments.

Blue-chip stocks are seen as a cornerstone in a beginner’s investment portfolio due to their reliability and long-term growth potential.

Examples of Blue-Chip Stocks

Some well-known examples of blue-chip stocks include:

- Apple Inc. (AAPL)

- Microsoft Corporation (MSFT)

- The Coca-Cola Company (KO)

- Johnson & Johnson (JNJ)

- Procter & Gamble Co. (PG)

- Visa Inc. (V)

These companies have a solid track record of performance, financial stability, and market dominance, making them attractive investment options for beginners looking to build a diversified and resilient portfolio.

Benefits of Investing in Blue-Chip Stocks

Investing in blue-chip stocks can offer several advantages for beginners looking to build a strong investment portfolio. Blue-chip stocks are shares of well-established companies with a history of stable performance and reliable dividends.

Stability and Consistent Returns

Blue-chip stocks are known for their stability, as they belong to reputable companies that have stood the test of time. These companies often have a strong market presence, diverse revenue streams, and solid financial health. As a result, investing in blue-chip stocks can provide investors with a sense of security, knowing that they are backing companies with a proven track record of success.Moreover, blue-chip stocks typically offer consistent returns in the form of dividends and capital appreciation.

These companies tend to weather market fluctuations better than smaller, riskier stocks, making them a reliable source of income for investors. By investing in blue-chip stocks, beginners can benefit from a steady stream of returns over the long term.

Comparison to Other Investments

When compared to other types of investments, such as growth stocks or speculative ventures, blue-chip stocks often outperform due to their stability and reliability. While growth stocks may offer higher potential returns, they also come with greater risks and volatility. On the other hand, blue-chip stocks provide a balance of growth and stability, making them a more attractive option for beginners looking to minimize risk while still achieving solid returns.Overall, investing in blue-chip stocks can be a smart choice for beginners seeking to build a resilient and profitable investment portfolio over time.

Factors to Consider When Choosing Blue-Chip Stocks

When beginners are looking to invest in blue-chip stocks, there are several key factors they should consider to make informed decisions. Evaluating the financial health and stability of a blue-chip company, as well as understanding the importance of long-term performance and growth prospects, are crucial steps in the investment process.

Financial Health and Stability Evaluation

- Check the company’s financial statements, including revenue, earnings, and cash flow, to assess its stability.

- Review the company’s debt levels and how it manages its debt to ensure it is not overleveraged.

- Look at the company’s dividend history and payout ratio to gauge its ability to sustain dividends over time.

- Consider the company’s competitive position in the industry and its market share to evaluate its long-term prospects.

Importance of Long-Term Performance and Growth Prospects

- Focus on companies with a consistent track record of revenue and earnings growth over the years.

- Research the company’s industry trends and market opportunities to understand its potential for future growth.

- Consider the company’s investments in research and development, as well as innovation, to stay competitive in the market.

- Look at the company’s management team and their strategic vision for driving growth and shareholder value in the long run.

Risks Associated with Blue-Chip Stocks

Investing in blue-chip stocks comes with its own set of risks, even though they are considered relatively stable compared to other types of investments. It’s important for beginners to be aware of these risks to make informed decisions and manage their investments effectively.

Market Volatility and its Impact on Blue-Chip Stocks

Market volatility refers to the rapid and unpredictable changes in the stock market, which can have a significant impact on blue-chip stocks. While these stocks are known for their stability, they are not immune to market fluctuations. In times of volatility, even blue-chip stocks can experience price declines, which may affect the overall value of the investment.

Strategies to Manage Risks When Investing in Blue-Chip Stocks

- Diversification: One way to manage risks is to diversify your investment portfolio by including different types of assets, industries, and companies. This can help spread out the risk and minimize the impact of any single stock’s performance on your overall portfolio.

- Long-Term Perspective: Instead of focusing on short-term market fluctuations, consider adopting a long-term investment strategy when investing in blue-chip stocks. This can help you ride out any temporary downturns in the market and benefit from the overall growth of the company over time.

- Stay Informed: Keep yourself updated on the latest market trends, company news, and economic indicators that may impact the performance of blue-chip stocks. This can help you make informed decisions and react to any changes in the market effectively.

- Set Stop-Loss Orders: Consider setting stop-loss orders to limit your losses in case the price of a blue-chip stock drops below a certain level. This can help you protect your investment and prevent significant losses in volatile market conditions.

In conclusion, Blue-chip stocks offer a solid foundation for beginners looking to build wealth steadily over time. With careful consideration and risk management, these stocks can play a valuable role in your investment success.

Key Questions Answered

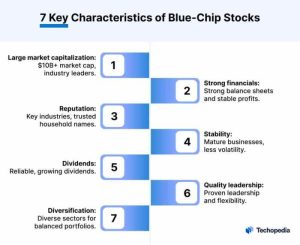

What are the characteristics of blue-chip stocks?

Blue-chip stocks are typically large, well-established companies with a history of stable performance and reliable dividends.

How do blue-chip stocks compare to other types of investments?

Blue-chip stocks are known for their stability and consistent returns, making them less risky than some other investment options.

What risks should beginners be aware of when investing in blue-chip stocks?

Beginners should watch out for market volatility and potential downturns that can affect the value of blue-chip stocks.