Exploring the world of Blue-chip stocks for a diversified portfolio, this introduction sets the stage for a deep dive into the topic, offering insights and analysis in a compelling and informative manner.

Providing readers with a comprehensive understanding of the significance and benefits of including blue-chip stocks in a diversified portfolio.

Blue-Chip Stocks

Blue-chip stocks are shares of well-established companies with a history of stable performance, strong financials, and a reputable brand presence in the market. These stocks are considered to be reliable and low-risk investment options due to their consistent track record of delivering returns to investors.

Stability of Blue-Chip Stocks

Blue-chip stocks are considered stable investment options for several reasons. Firstly, these companies typically have a long history of profitability and growth, which instills confidence in investors. Secondly, blue-chip stocks often pay regular dividends, providing a steady income stream. Lastly, these companies are usually leaders in their respective industries, with strong market positions that help them weather economic downturns more effectively.

Examples of Blue-Chip Stocks

- Apple Inc. (AAPL)

-Technology Sector - Johnson & Johnson (JNJ)

-Healthcare Sector - The Coca-Cola Company (KO)

-Consumer Goods Sector - Procter & Gamble Co. (PG)

-Consumer Staples Sector - Exxon Mobil Corporation (XOM)

-Energy Sector

Historical Performance of Blue-Chip Stocks

During economic downturns, blue-chip stocks have historically shown more resilience compared to other types of stocks. Investors tend to flock to these stable companies during uncertain times, driving up their stock prices. Additionally, the strong financial position of blue-chip companies allows them to navigate challenging market conditions and emerge stronger on the other side.

Importance of Diversification

When it comes to investing, diversification is a key strategy that involves spreading your investments across different asset classes to reduce risk.

Concept of Portfolio Diversification

Portfolio diversification is the practice of investing in a variety of assets to minimize the impact of any single investment on the overall portfolio. By spreading investments across different industries, sectors, and asset classes, investors can reduce the risk of significant losses if one particular investment performs poorly.

Why Blue-Chip Stocks are Included in a Diversified Portfolio

Blue-chip stocks are often included in a diversified portfolio due to their reputation for stability, strong performance, and consistent dividends. These large, well-established companies have a history of weathering economic downturns and are considered safer investments compared to smaller, riskier stocks. By adding blue-chip stocks to a portfolio, investors can benefit from their steady growth and reliable returns.

Reducing Overall Portfolio Risk with Blue-Chip Stocks

Adding blue-chip stocks to a diversified portfolio can help reduce overall risk by providing a buffer against market volatility. Since blue-chip stocks are known for their stability and solid financial performance, they can act as a hedge against more volatile investments. In times of market uncertainty, blue-chip stocks tend to hold their value better than riskier assets, helping to minimize losses and protect the overall portfolio.

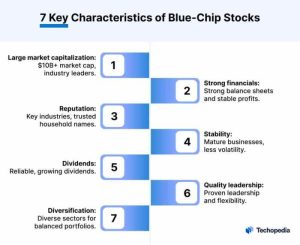

Characteristics of Blue-Chip Stocks

Blue-chip stocks are known for their stability, reliability, and long-established reputation in the market. They are typically large, well-established companies with a history of consistent performance.

Key Characteristics of Blue-Chip Stocks

- Strong Financials: Blue-chip stocks have solid financial statements, including steady revenue growth, healthy profit margins, and manageable debt levels.

- Market Dominance: These companies are leaders in their respective industries, often holding a significant market share.

- Longevity: Blue-chip stocks have a history of operating successfully for many years, demonstrating their resilience and ability to weather economic downturns.

- Dividend Payments: Blue-chip stocks are known for their consistent dividend payments to shareholders, providing an additional source of income.

Volatility Comparison

Blue-chip stocks are generally less volatile compared to other types of stocks, such as small-cap or growth stocks. Their stability and market dominance contribute to lower price fluctuations, making them a popular choice for conservative investors seeking steady returns.

Dividend-Paying History

Blue-chip stocks have a strong track record of paying dividends to shareholders. These dividends can provide investors with a reliable income stream, especially during periods of market uncertainty. Companies with a consistent dividend history are often considered more attractive to income-oriented investors.

Role of Market Capitalization

Market capitalization plays a crucial role in identifying blue-chip stocks. These companies typically have large market capitalizations, reflecting their size and significance in the market. Investors often look for companies with substantial market capitalization as a key criteria for blue-chip stock selection.

Building a Diversified Portfolio with Blue-Chip Stocks

When building a diversified portfolio with blue-chip stocks, it is important to carefully select these stable and reliable investments to balance out your overall portfolio. Blue-chip stocks are known for their long-standing reputation, strong financial performance, and stability, making them a valuable addition to any investment strategy. Here is a step-by-step guide on how to select blue-chip stocks for a diversified portfolio.

Selecting Blue-Chip Stocks for Diversification

When selecting blue-chip stocks for your portfolio, consider the following factors:

- Company Reputation: Look for companies with a solid reputation in their industry and a history of consistent growth.

- Financial Performance: Analyze the company’s financial statements, revenue growth, and profitability over time.

- Dividend History: Blue-chip stocks often pay dividends, so consider companies with a track record of paying dividends consistently.

- Market Capitalization: Focus on companies with large market capitalization, as they are typically more stable and less volatile.

Balancing Blue-Chip Stocks with Other Investments

To balance blue-chip stocks with other types of investments in your portfolio, consider adding different asset classes such as bonds, real estate, and growth stocks. Diversifying across various sectors and industries can help mitigate risk and maximize returns. It is essential to maintain a balanced portfolio that aligns with your financial goals and risk tolerance.

Impact of Economic Factors on Blue-Chip Stocks

Blue-chip stocks are influenced by various economic factors such as interest rates, inflation, and market trends. Economic stability and growth can positively impact the performance of blue-chip stocks, while economic downturns may lead to volatility and fluctuations in stock prices. It is crucial to stay informed about economic indicators and global events that could affect the market.

Role of Blue-Chip Stocks in Long-Term Investment Strategies

Blue-chip stocks play a vital role in long-term investment strategies by providing stability, steady growth, and reliable income through dividends. These stocks are well-suited for investors looking to build wealth gradually over time and withstand market fluctuations. Including blue-chip stocks in a diversified portfolio can help investors achieve their financial goals and secure their financial future.

In conclusion, Blue-chip stocks are a crucial component of a well-rounded investment strategy, offering stability and growth potential for long-term investors.

Commonly Asked Questions

What makes blue-chip stocks stand out as investment options?

Blue-chip stocks are known for their long history of stable performance and reliable dividends.

How can blue-chip stocks help reduce portfolio risk?

By adding blue-chip stocks to a diversified portfolio, investors can mitigate risk through their stability and resilience.

What role does market capitalization play in identifying blue-chip stocks?

Market capitalization is a key factor in determining blue-chip status, with large, established companies often falling into this category.