Embark on a journey through the realm of blue-chip stocks for retirement portfolios, where stability and prosperity await those who choose wisely. Discover the key to securing your financial future with the best blue-chip stocks available.

Introduction to Blue-Chip Stocks

Blue-chip stocks are well-established companies with a history of stable earnings and a strong financial position. These stocks are known for their reliability and are considered to be among the safest investments in the stock market.

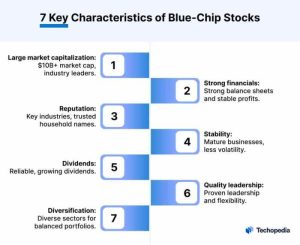

Characteristics of Blue-Chip Stocks

- Large market capitalization: Blue-chip companies are typically large-cap companies with market capitalizations in the billions.

- Stable dividend payments: These companies often have a track record of paying regular dividends to their shareholders.

- Strong brand recognition: Blue-chip companies are household names with well-known brands that have stood the test of time.

- Low volatility: Blue-chip stocks tend to be less volatile than other stocks, providing a sense of stability to investors.

Examples of Blue-Chip Companies

Some well-known blue-chip companies include:

- Apple Inc. (AAPL)

- Microsoft Corporation (MSFT)

- The Coca-Cola Company (KO)

- Johnson & Johnson (JNJ)

Importance of Blue-Chip Stocks in Retirement Portfolios

Blue-chip stocks are considered ideal for retirement portfolios due to their stability, consistent returns, and long-term wealth preservation capabilities.

Stability and Consistent Returns

Blue-chip stocks are shares of large, well-established companies with a history of stable performance, strong financials, and a track record of weathering market downturns. These companies are often leaders in their respective industries, making them less susceptible to economic volatility. As a result, blue-chip stocks tend to provide steady returns over time, making them a reliable source of income for retirees.

Long-Term Wealth Preservation

Investing in blue-chip stocks can help retirees preserve their wealth over the long term. These companies typically have a history of paying dividends, which can provide a steady income stream during retirement. Additionally, blue-chip stocks have the potential for capital appreciation over time, allowing retirees to grow their wealth while minimizing risk.

Factors to Consider When Selecting Blue-Chip Stocks for Retirement Portfolios

When choosing blue-chip stocks for retirement portfolios, investors should carefully consider several key factors to ensure long-term growth and stability in their investments.

Importance of Dividend Yield and Growth in Blue-Chip Companies

One important factor to consider when selecting blue-chip stocks is the dividend yield and growth potential of the company. Blue-chip companies are known for their consistent dividend payments, which can provide a steady income stream for retirees. It is crucial to look for companies with a history of increasing dividends over time, as this indicates financial strength and stability.

Significance of a Company’s Track Record and Financial Stability

Another crucial factor to consider is the company’s track record and financial stability. Blue-chip stocks are typically well-established companies with a proven track record of success. Investors should look for companies with strong financials, low debt levels, and a history of consistent earnings growth. This can help ensure that the company will continue to perform well in the future, providing a reliable source of income for retirees.

Best Blue-Chip Stocks for Retirement Portfolios

Investing in blue-chip stocks is a popular choice for retirement portfolios due to their stability, consistent dividend payouts, and long-term growth potential. Here are some top blue-chip stocks that are recommended for retirement portfolios:

1. Apple Inc. (AAPL)

Apple is a leading technology company known for its innovative products and services. With a market capitalization of over $2 trillion, Apple has a strong track record of revenue growth and profitability. The stock has shown consistent growth over the years and is considered a solid investment for retirement portfolios.

2. Johnson & Johnson (JNJ)

Johnson & Johnson is a healthcare giant with a market capitalization of around $400 billion. The company’s diversified portfolio of pharmaceuticals, medical devices, and consumer health products provides stability and growth potential. With a history of increasing dividends, Johnson & Johnson is a reliable choice for retirement investors.

3. The Coca-Cola Company (KO)

Coca-Cola is a well-known beverage company with a market capitalization of over $200 billion. The company’s strong brand presence and global reach make it a stable investment option for retirement portfolios. Coca-Cola has a long history of delivering steady returns and is considered a defensive stock in times of market volatility.

4. Microsoft Corporation (MSFT)

Microsoft is a leading technology company with a market capitalization of over $2 trillion. The company’s diverse product offerings in software, cloud services, and hardware make it a strong contender for retirement portfolios. Microsoft’s consistent revenue growth and strong financial position make it a top choice for long-term investors.These blue-chip stocks belong to different sectors such as technology, healthcare, consumer goods, and offer investors a diversified portfolio with exposure to stable and growing industries.

Consider including some of these top blue-chip stocks in your retirement portfolio for long-term wealth accumulation and financial security.

In conclusion, investing in the best blue-chip stocks for retirement portfolios can be a strategic move towards achieving financial stability and long-term success. Make informed decisions and watch your wealth grow steadily over time with these top picks.

Key Questions Answered

What are the main advantages of investing in blue-chip stocks for retirement?

Blue-chip stocks offer stability, consistent returns, and long-term wealth preservation, making them ideal for retirement portfolios.

How should investors choose the best blue-chip stocks for their retirement portfolios?

Investors should consider factors like dividend yield, growth potential, track record, and financial stability of blue-chip companies.

Can you provide examples of well-known blue-chip companies?

Some well-known blue-chip companies include Apple, Microsoft, Coca-Cola, and Johnson & Johnson.