Exploring the world of Blue-chip stock investment strategy, this introduction sets the stage for a detailed discussion on the significance of these stocks in building a resilient portfolio and achieving substantial growth over time.

Diving deeper into the characteristics that define blue-chip stocks and their role in an investment strategy, this overview will shed light on why they are considered as safe investments and how they stand out from other investment options.

BLUE-CHIP STOCKS

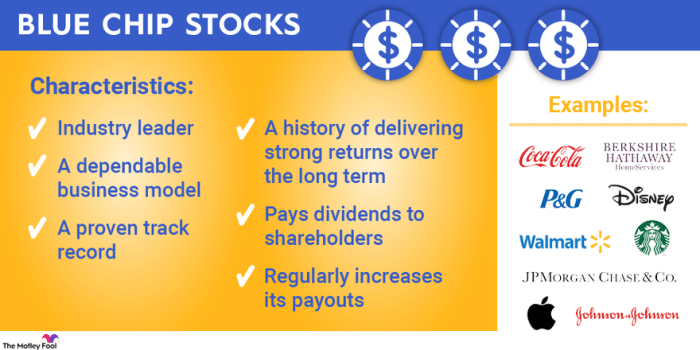

Blue-chip stocks are shares of large, well-established companies with a history of stable earnings and a strong reputation in the market. These companies are typically industry leaders and have a long track record of success.

Investors consider blue-chip stocks to be safe investments due to their stability and reliability. These companies are known for weathering economic downturns and maintaining consistent dividend payments over time. Blue-chip stocks are seen as a less risky option compared to smaller, more volatile companies.

Examples of Blue-Chip Stocks

- Apple Inc. (AAPL)

- Microsoft Corporation (MSFT)

- Johnson & Johnson (JNJ)

- The Coca-Cola Company (KO)

- Procter & Gamble Co. (PG)

BLUE-CHIP STOCK INVESTMENT STRATEGY

Investing in blue-chip stocks is an essential component of a diversified portfolio. These stocks are known for their stability, reliability, and long track record of performance. Including blue-chip stocks in your investment mix can help mitigate risk and provide steady returns over the long term.Blue-chip stocks are typically large, well-established companies with a history of strong financial performance. They are leaders in their respective industries and are known for their solid balance sheets, consistent dividend payments, and resilience during market downturns.

Investors are attracted to blue-chip stocks for their lower volatility and potential for capital appreciation.

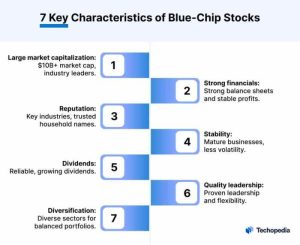

Characteristics of Blue-Chip Stocks

- Large market capitalization

- Long history of stable earnings

- Strong brand presence and market leadership

- Regular dividend payments

- Low debt-to-equity ratio

Blue-chip stock investment strategies differ from other types of investments, such as growth stocks or value stocks. While growth stocks offer higher potential returns but come with higher risk, blue-chip stocks prioritize stability and consistent performance. On the other hand, value stocks are undervalued companies that have the potential for growth but may carry more risk than blue-chip stocks.Investors often turn to blue-chip stocks as a safe haven during market volatility or economic uncertainty.

These stocks can act as a defensive position in a portfolio, providing a buffer against market downturns while still offering the potential for long-term growth. By diversifying your investment portfolio with blue-chip stocks, you can achieve a balanced mix of risk and return.

RISK MANAGEMENT

When it comes to managing investment risks, the blue-chip stock investment strategy offers a solid foundation. Blue-chip stocks are shares of well-established companies with a history of stable performance, strong financials, and a solid reputation in the market. These characteristics make them less volatile compared to other types of stocks, which in turn helps in managing risks effectively.

One of the key risk management techniques associated with blue-chip stock investments is the focus on long-term growth and stability. Investors who follow this strategy aim to hold onto their blue-chip stocks for an extended period, benefiting from the consistent returns and potential dividend payments these companies offer. This approach helps in reducing the impact of short-term market fluctuations and economic uncertainties on the investment portfolio.

Role of Diversification

Diversification plays a crucial role in reducing risk in blue-chip stock investments. By spreading out investments across different blue-chip companies operating in various industries, investors can minimize the impact of adverse events that may affect a specific sector or company. Diversification helps in balancing the overall risk exposure of the portfolio, ensuring that potential losses from one investment can be offset by gains from others.

LONG-TERM GROWTH

Investing in blue-chip stocks can significantly contribute to long-term growth due to the stable and established nature of these companies. Blue-chip stocks are typically large, reputable companies with a history of consistent performance and reliable dividends. By holding onto these stocks over an extended period, investors can benefit from the compounding effect and potential capital appreciation.

Comparison with Other Investments

Blue-chip stocks generally offer a more stable and predictable growth potential compared to other types of investments such as growth stocks or speculative investments. While growth stocks may have higher growth potential in the short term, they also come with higher volatility and risk. On the other hand, blue-chip stocks tend to withstand market fluctuations better and provide more reliable returns over the long run.

Historical Performance

Historically, blue-chip stocks have demonstrated strong long-term growth potential. These companies have shown resilience during economic downturns and have continued to deliver steady returns to investors. For example, many blue-chip stocks have consistently increased their dividends over the years, providing shareholders with a reliable source of income. Additionally, the overall value of blue-chip stocks has shown a consistent upward trend over extended periods, making them a popular choice for long-term investors looking for stable growth opportunities.

In conclusion, Blue-chip stock investment strategy emerges as a reliable and strategic approach to managing risks, fostering long-term growth, and securing a stable investment portfolio. By understanding the nuances of this strategy, investors can navigate the complex world of stock investments with confidence and clarity.

Question Bank

What are blue-chip stocks?

Blue-chip stocks refer to shares of large, established, and financially stable companies with a history of reliable performance.

How do blue-chip stocks help in managing investment risks?

Blue-chip stocks are considered safe investments due to their stability and consistent dividends, which can act as a hedge against market volatility.

What role does diversification play in reducing risk in blue-chip stock investments?

Diversification is crucial in spreading risk across different assets, including blue-chip stocks, to minimize the impact of market fluctuations on a portfolio.