Delve into the realm of high dividend blue-chip stocks, where stability meets lucrative returns. This captivating introduction sets the stage for a journey through the world of reliable investments intertwined with significant dividends.

Explore the nuances of high dividend blue-chip stocks and uncover the potential they hold for investors seeking a balance between security and profitability.

Introduction to Blue-Chip Stocks

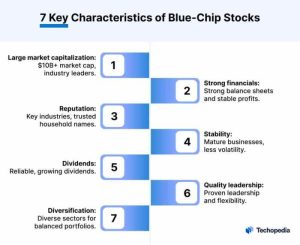

Blue-chip stocks are shares of large, well-established companies with a history of stable earnings and a strong reputation in the market. These companies are typically industry leaders and household names.

Blue-chip stocks are considered stable and reliable investments due to their strong financial performance, consistent dividend payments, and overall resilience during economic downturns. Investors often turn to blue-chip stocks as a safe haven during times of market volatility.

Historical Performance of Blue-Chip Stocks

Blue-chip stocks have historically outperformed other types of stocks over the long term. Their solid track record of delivering steady returns and weathering market fluctuations has made them a popular choice for conservative investors seeking capital preservation and income generation.

High Dividend Blue-Chip Stocks

When it comes to investing in blue-chip stocks, high dividend blue-chip stocks are a popular choice among investors seeking stable returns and income. These stocks are known for their combination of strong financial stability, solid track record, and consistent dividend payouts.

Definition and Difference

High dividend blue-chip stocks are shares of well-established companies that have a history of paying out dividends at a higher rate compared to regular blue-chip stocks. While regular blue-chip stocks are renowned for their stability and reliability, high dividend blue-chip stocks offer investors additional income through higher dividend yields.

- Examples of High Dividend Blue-Chip Stocks:

- 1. AT&T Inc. (T)

-a telecommunications giant known for its generous dividend payouts. - 2. Exxon Mobil Corporation (XOM)

-an energy company with a long history of paying dividends. - 3. Procter & Gamble Company (PG)

-a consumer goods company that consistently rewards shareholders with dividends.

Significance of Dividends

Dividends play a crucial role for investors holding blue-chip stocks, as they provide a steady stream of passive income in addition to potential capital appreciation. For high dividend blue-chip stocks, the regular dividend payouts can represent a significant portion of the total return on investment, making them an attractive option for income-focused investors.

Benefits of Investing in High Dividend Blue-Chip Stocks

Investing in high dividend blue-chip stocks can offer numerous advantages for investors looking to grow their wealth and generate passive income. These stocks are known for their stability, strong track record of performance, and consistent dividend payouts, making them a popular choice among both beginner and experienced investors.

Comparative Advantages

- Stability: Blue-chip stocks are typically issued by well-established, financially sound companies with a long history of success. This stability can provide a sense of security for investors, especially during times of market volatility.

- Dividend Income: High dividend blue-chip stocks pay out a portion of their earnings to shareholders in the form of dividends. This can provide investors with a steady stream of passive income, which can be reinvested or used to cover expenses.

- Growth Potential: While blue-chip stocks are known for their stability, many of them also offer capital appreciation potential. This means that investors can benefit from both dividend income and the potential for their investment to grow over time.

- Diversification: Including high dividend blue-chip stocks in a diversified investment portfolio can help spread risk and reduce overall volatility. This can help investors weather downturns in specific sectors or industries.

Source of Passive Income

High dividend blue-chip stocks are an attractive option for investors looking to generate passive income. By investing in these stocks, individuals can build a portfolio that produces regular dividend payments without the need for active trading or management. This passive income can be particularly beneficial for retirees or those looking to supplement their existing income streams.

Risks Associated with High Dividend Blue-Chip Stocks

Investing in high dividend blue-chip stocks can offer attractive returns, but it also comes with certain risks that investors need to be aware of. These risks can impact the performance of these stocks and potentially lead to losses if not managed properly.

Economic Factors Impacting High Dividend Blue-Chip Stocks

- Economic Recession: During an economic downturn, high dividend blue-chip stocks may underperform as companies struggle to maintain profitability and sustain dividend payments.

- Interest Rates: Changes in interest rates can affect the attractiveness of dividend-paying stocks compared to other investment options, leading to fluctuations in stock prices.

- Inflation: High inflation rates can erode the real value of dividend income, reducing the overall returns for investors.

Market Conditions and Performance

- Market Volatility: High dividend blue-chip stocks are not immune to market fluctuations and can experience significant price swings in response to market conditions.

- Company-Specific Risks: While blue-chip stocks are considered stable, individual companies can still face challenges such as regulatory issues, management changes, or competitive pressures that impact stock performance.

- Dividend Cuts: Companies may reduce or suspend dividend payments during tough times, causing stock prices to decline and affecting investor income.

Strategies for Mitigating Risks

- Diversification: Spread investments across different sectors and asset classes to reduce exposure to any single company or industry.

- Research and Due Diligence: Conduct thorough analysis of companies before investing to understand their financial health, dividend history, and future prospects.

- Monitoring: Stay informed about economic and market trends that could impact high dividend blue-chip stocks and be prepared to adjust your portfolio accordingly.

In conclusion, high dividend blue-chip stocks offer a compelling investment opportunity that combines stability, reliable returns, and the potential for passive income. Venture into this lucrative market with confidence and strategic insights to enhance your investment portfolio.

Q&A

Are high dividend blue-chip stocks suitable for conservative investors?

Yes, high dividend blue-chip stocks are ideal for conservative investors looking for stability and consistent returns.

How do economic factors affect the performance of high dividend blue-chip stocks?

Economic factors such as interest rates and market conditions can impact the performance of these stocks, influencing dividend payouts and stock prices.

What is the main advantage of investing in high dividend blue-chip stocks?

The primary benefit is the combination of reliable returns from established companies with the additional income generated through dividends.